Procurement InitiativesOur Company / Procurement

Explanation of Our Procurement Policy

- Positioning of the Policy for Suppliers

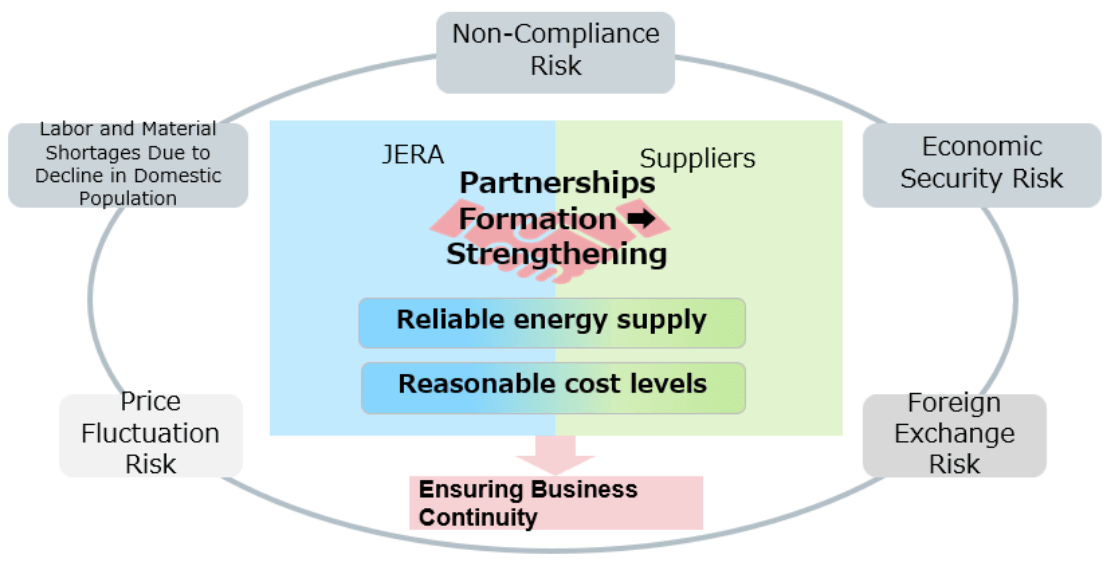

Our O&M Engineering divisions aim to address global energy challenges by ensuring a stable supply (Stability), providing affordable electricity and services (Affordability), and driving the transition to a decarbonized society (Sustainability).

In alignment with our company-wide commitment to building partnerships, we promote mutually beneficial relationships across the supply chain through internal employee education, external announcements via our official website, and ongoing engagement with business partners and suppliers.

Additionally, the Procurement Planning Group has established a Procurement Policy to uphold universal values such as safety and fairness in material transactions. This policy is designed to foster partnerships with suppliers who demonstrate the capacity to balance stable supply with cost efficiency, thus ensuring business continuity. - Supply Chain Management in Procurement

Our procurement activities prioritize quality, cost, delivery timelines, supply stability, and reliability. Simultaneously, we implement ESG-based supply chain management by addressing key issues such as environmental sustainability, human rights, and governance in collaboration with strategic partners representing significant transaction volumes.

From an ESG perspective, we evaluate sector- and product-specific risks—such as supply chain structure, labor conditions, energy consumption, resource intensity, emissions, pollution potential, etc.)—using external risk management tools before initiating transactions. We also conduct periodic assessments of our partners’ ESG initiatives through various evaluation mechanisms to ensure continuous risk management.

Sharing Our Policy(For Partner Development and Training Purposes)

- Procurement Policy Trainings

We host procurement policy briefings each year to communicate current procurement practices and foster a deeper understanding of JERA's future goals. These trainings provide a platform for shared learning and growth between us and our suppliers as a place to discuss a range of topics, such as procurement policies and decarbonization, in our initiatives to enhance mutual ESG performance. They also encourage suppliers to independently advance improvements in environmental sustainability, safety, and human rights. JERA also facilitates discussions and shares insights on pressing global issues, such as environmental challenges and human rights violations, addressing practical concerns as necessary.

Training Participating Partners(FY 2024 Result)

| 53 companies(in person) |

| A Total of 2,637 companies as of September 2024 |

Examples of Specific ESG Initiatives

- Supply Chain Assessments

In FY2023, we launched supply chain assessments (SC assessments) targeting key partner that account for the top 67.6% of transaction value in the previous fiscal year. The primary objective of these assessments is to ensure transaction integrity for strengthening partnerships in material procurement. The SC assessment process involves internal self-assessments by the procurement team and external assessments by domestic and international partners. Through these assessments, we aim to monitor and support the ESG initiatives of our suppliers.

Reference: SC Assessment Results

| Total Number of Suppliers | Total Suppliers in Material Procurement 2,637 companies (as of September 2024) |

|---|---|

| Number of Significant Suppliers* | 23 companies |

| Significant Suppliers Number of companies who responded to the supply chain assessment survey |

21 companies |

| Response rate (%) | 91.3% |

* Significant Suppliers are suppliers that account for the top 67.6% of transaction value in the previous fiscal year.

- Nine Key Focus Areas in Our Procurement (SC Assessment Items)

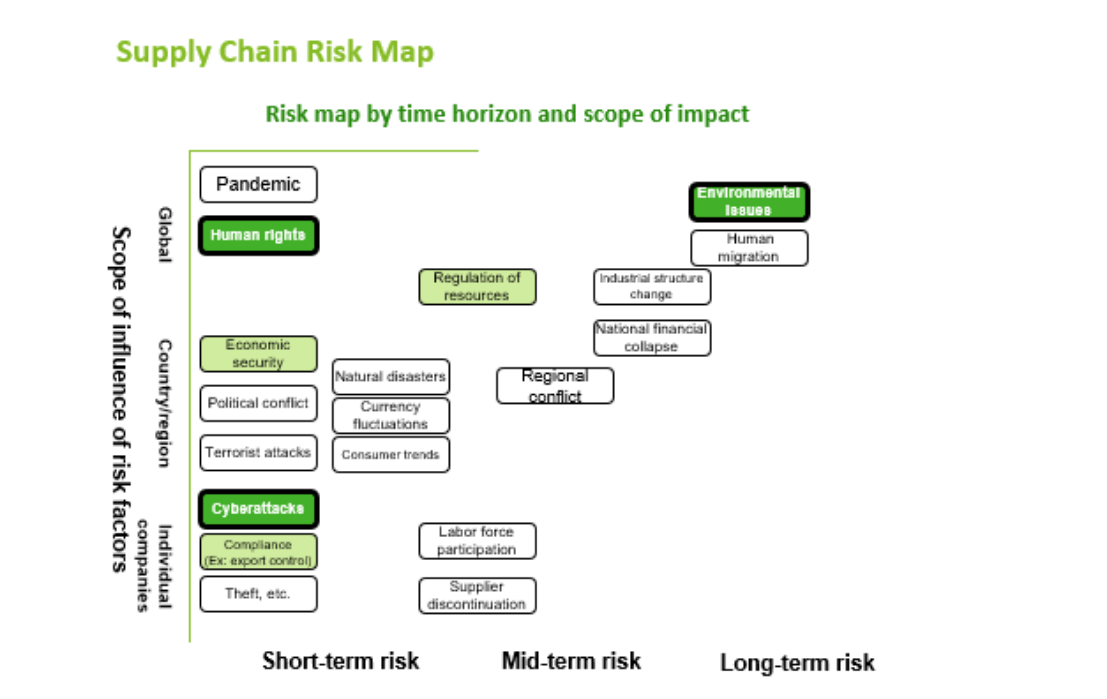

Drawing on the JEITA’s “Responsible Business Conduct Guidelines,” which are widely adopted in Japan’s electric power sector, we identified 26 questions across nine key focus areas. These focus areas are mapped against the time horizon (short-, medium-, long-term) and scope (company-specific, regional, global) of supply chain risks.

Source: Compiled using sources such as “FY2021 International Economic Survey on Internal and External Economic Growth Strategy Development (Survey on the Visualization of the Global Supply Chain),” published by the Ministry of Economy, Trade and Industry.

Reference: Assessment Items

| Major Items | Questions |

|---|---|

| (1) Corporate Social Responsibility (CSR) | Our commitment to social responsibility in management policy |

| Social responsibility initiatives in the supply chain | |

| (2) Compliance with Laws, Regulations and Social Norms | Compliance policy |

| Prohibition of corruption, etc. | |

| Proper subcontracting/abuse of a superior bargaining position | |

| Prohibition of collusion, etc. | |

| Involvement in antisocial forces | |

| Security Export Control | |

| Economic security | |

| Whistleblowing system | |

| (3) Human Rights | Human rights policy |

| International rules | |

| (4) Occupational Health and Safety | Occupational health and safety policy |

| (5) Risk Management | Risk management/BCP |

| (6) Environment | Environmental policy |

| Development of environmentally friendly products and services | |

| (7) Information security | Information security policy and structure |

| Protection of privacy and personal information | |

| (8) Sustainable Development Throughout the Supply Chain and Contribution to Local Communities | Guidelines for supplier behavior |

| (9) Standards for Promoting Subcontracting | Clarification of procurement requirements |

| Fair pricing methods | |

| Payment rules | |

| Prohibition of unfair reductions and coercive negotiation tactics | |

| Fair cost sharing | |

| Management of intellectual property (IP) | |

| Unfair price reduction |

Assessment Results and Evaluation Standards

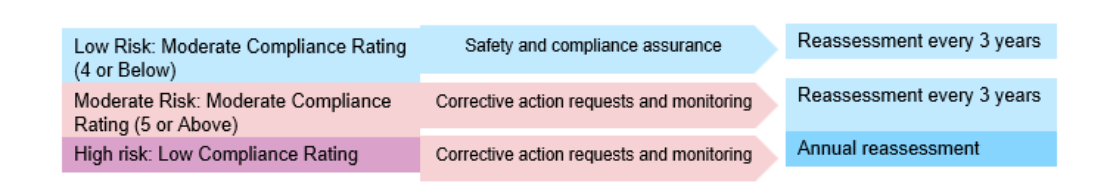

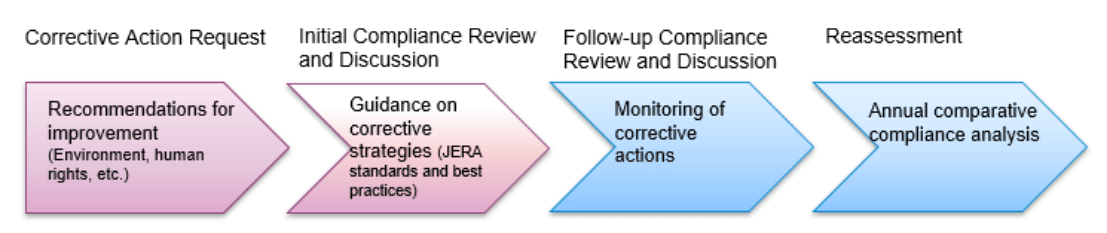

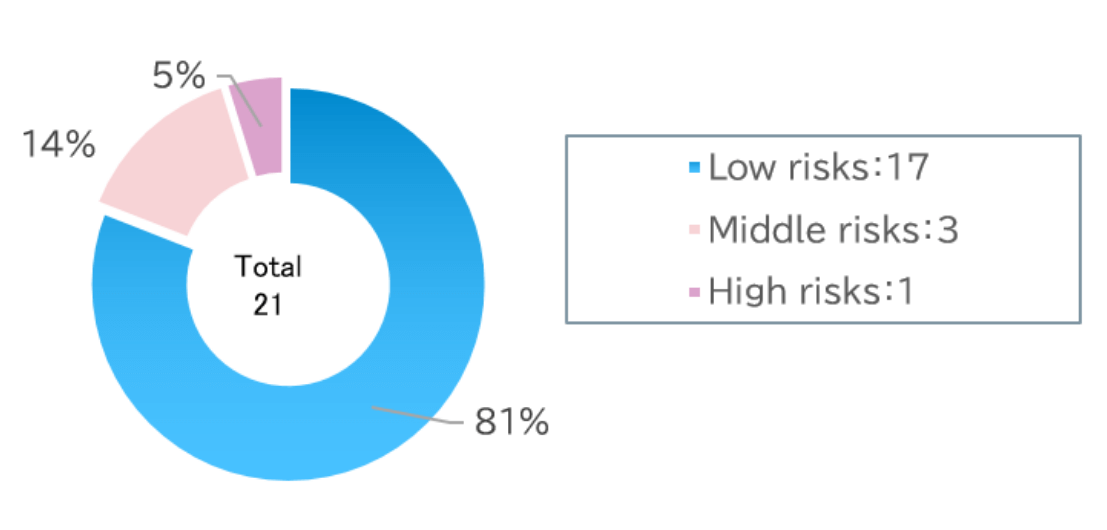

We evaluate supplier responses across nine key areas using a three-tier scale (low-, medium-, and high-risk) and engage with medium- and high-risk suppliers to implement a risk mitigation cycle.

If violations of our environmental or social policies are identified, we request corrective actions, conduct on-site inspections where necessary, and provide improvement support, with reassessments conducted in the subsequent fiscal year to track progress.

If corrective actions are not implemented within 12 months notwithstanding ongoing requests, we will consider additional measures, including a review of the feasibility of continuing the partnership(e.g., suspension of business).

Reference: Risk Reduction Targets

Reference: Risk Mitigation Cycle Through Engagement with High-Risk Partners

- FY2023 External Assessment Results and Responses

In FY2023, external assessments identified 4 out of 21 targeted companies (19%) as medium- or high-risk, necessitating corrective measures. Conversely, 17 companies (81%) were assessed as low-risk, with no corrective action required.

Reference: Progress on Improvement Support Initiatives Based on FY2023 Assessment Results

For the one high-risk company and three medium-risk companies, support for corrective measures was provided as part of corrective action plans.

In the FY2023 assessment, certain suppliers were identified as high-risk; however, the FY2024 reassessment confirmed that they had appropriately implemented the required corrective actions. Accordingly, their evaluations were updated to low-risk. A company-wide assessment, covering not only low-risk but also medium-risk suppliers, is scheduled to be conducted in FY2026.

(Examples of Aiding Corrective Action)

- December 2023: Conducted company visits to clarify evaluation criteria and corrective measures, requesting corrective action by the next fiscal year.

- May 2024: Conducted follow-up visits to review corrective actions, noted partial improvements, and requested further corrective action ahead of reassessment.

- November 2024: Conducted reassessment and confirmed improvement outcomes due to corrective action.