Climate- and Nature-related Disclosures (Response to TCFD and TNFD Recommendations)Sustainability

Fundamental Approach

As a global company committed to solving energy issues in Japan and around the world, we consider measures to combat climate change and conserve natural capital and biodiversity to be priority issues and have identified the relevant material issues. We have endorsed the Task Force on Climate-related Financial Disclosures (TCFD) recommendations since 2021, when we also joined the TCFD Consortium. In addition, in 2024, we participated in the TNFD Forum, which supports discussions and other activities of the Taskforce on Nature-related Financial Disclosures (TNFD).

With the aim of sustainably enhancing our corporate value, we have identified four elements—governance, risk management, strategy, and metrics and targets—in line with the TCFD and TNFD Recommendations that summarize our systems pertaining to climate change, natural capital, and biodiversity and the initiatives typified by the Three Approaches of JERA Zero CO2 Emissions 2050.

We will continue to disclose information in line with the TCFD and TNFD Recommendations and further enhance communication with investors and other stakeholders.

Governance

Decisions about important policies, new and updated targets, and other matters pertaining to measures to combat climate change and conserve natural capital and biodiversity are made by the Board of Directors or the Leadership Panel based on our corporate governance system. We have also established a Sustainability Promotion Committee for the purpose of enhancing sustainability management, this cross-divisional committee is chaired by the President, Director, CEO and COO and reports directly to the Board of Directors. It will examine measures to combat climate change, conserve natural capital and biodiversity, and address other environment-related issues.

Directors hold active discussions with outside experts and specialist organizations to keep pace with the latest information and findings, which they share with the Leadership Panel and other internal groups. We also host seminars regarding sustainability for our employees in addition to providing opportunities for them to have discussions with the directors. We are proactively working to further promote our sustainability activities by continuing to expand our directors' and employees' understanding of information and trends in climate change, natural capital, biodiversity, and other aspects of sustainability management.

Risk Management

We have established a risk management system headed by the President, Director, CEO and COO to understand and mitigate risks associated with corporate activities. The system conducts integrated risk management, categorized into operational, market, and credit risks. We identify risks pertaining to climate change, natural capital, and biodiversity in recognition of their impact on our business activities. Risks to be managed by directors are identified as "significant risks to be managed by management." The Risk Management Committee (chaired by the President, Director, CEO and COO) monitors and reviews the management status and plans for responding to these risks and then reports them to the Board of Directors at scheduled intervals or as needed.

Strategies

To identify risks and opportunities pertaining to climate change, natural capital, and biodiversity and prove our resilience, we conduct analysis with reference to the TCFD and TNFD frameworks.

Regarding climate change, we continue to conduct scenario analysis as in FY2023, identifying major risks and opportunities for our business and evaluating the financial impact to inform subsequent examination and implementation of appropriate measures.

Regarding natural capital and biodiversity, we conducted an analysis based on the LEAP approach* for the first time in FY2024. We located our interface with nature on a site-by-site basis, analyzed the dependencies and impacts of our business on nature and key risks and opportunities, and then examined measures and defined indicators.

- LEAP approach: Acronym for Locate, Evaluate, Assess, and Prepare, the TNFD's recommended steps for disclosure.

Strategies for Climate Change

Scenario Configuration

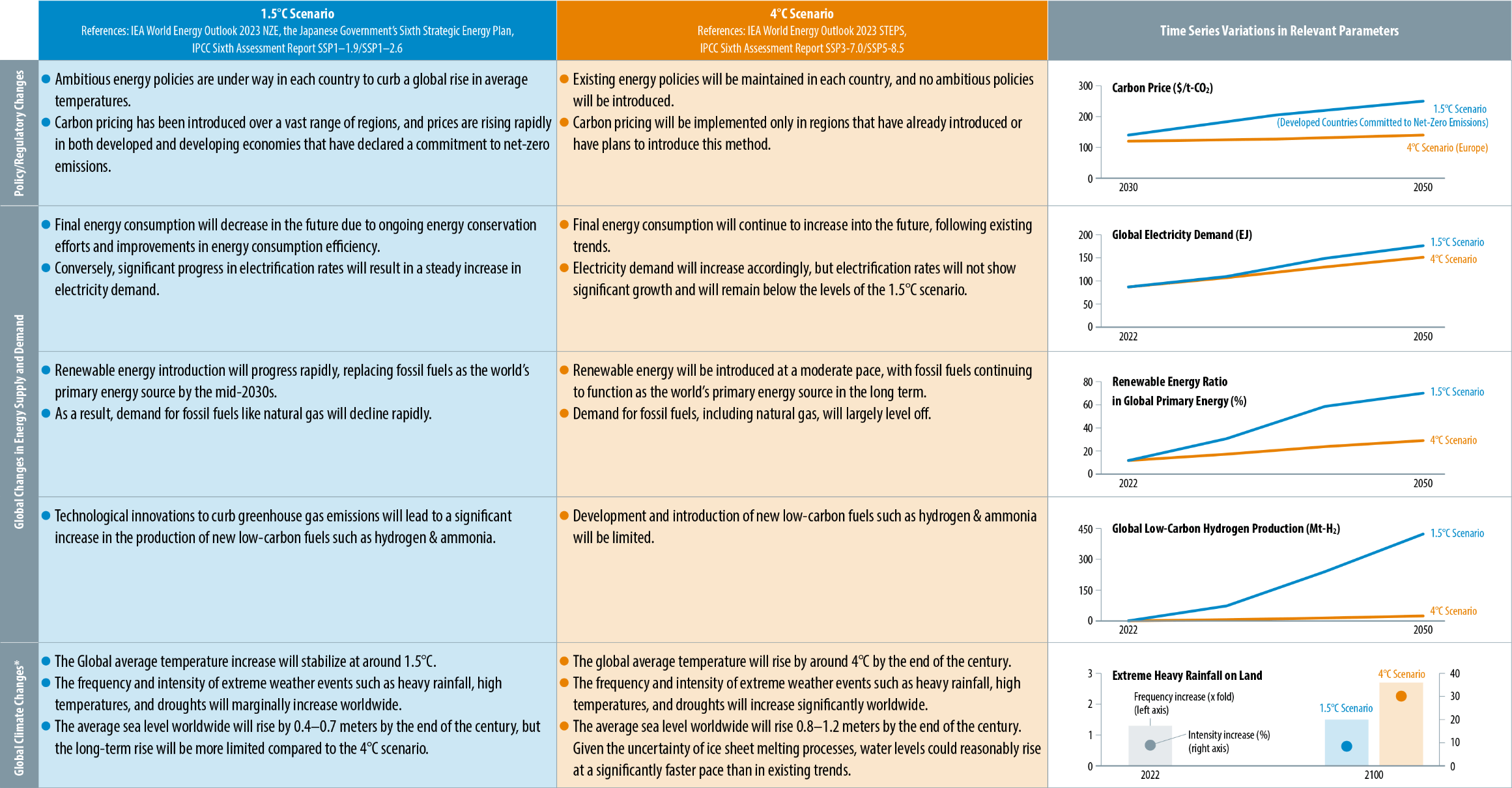

The following two scenarios have been established to analyze the risks and opportunities related to climate change across the entire value chain of our business.

- Numerical values in the scenario descriptions and graphs represent the deviation from values expected prior to the Industrial Revolution. "Extreme" refers to weather events with a probability of occurring once in 10 years.

Assessment of Impact on Our Business

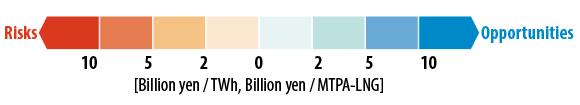

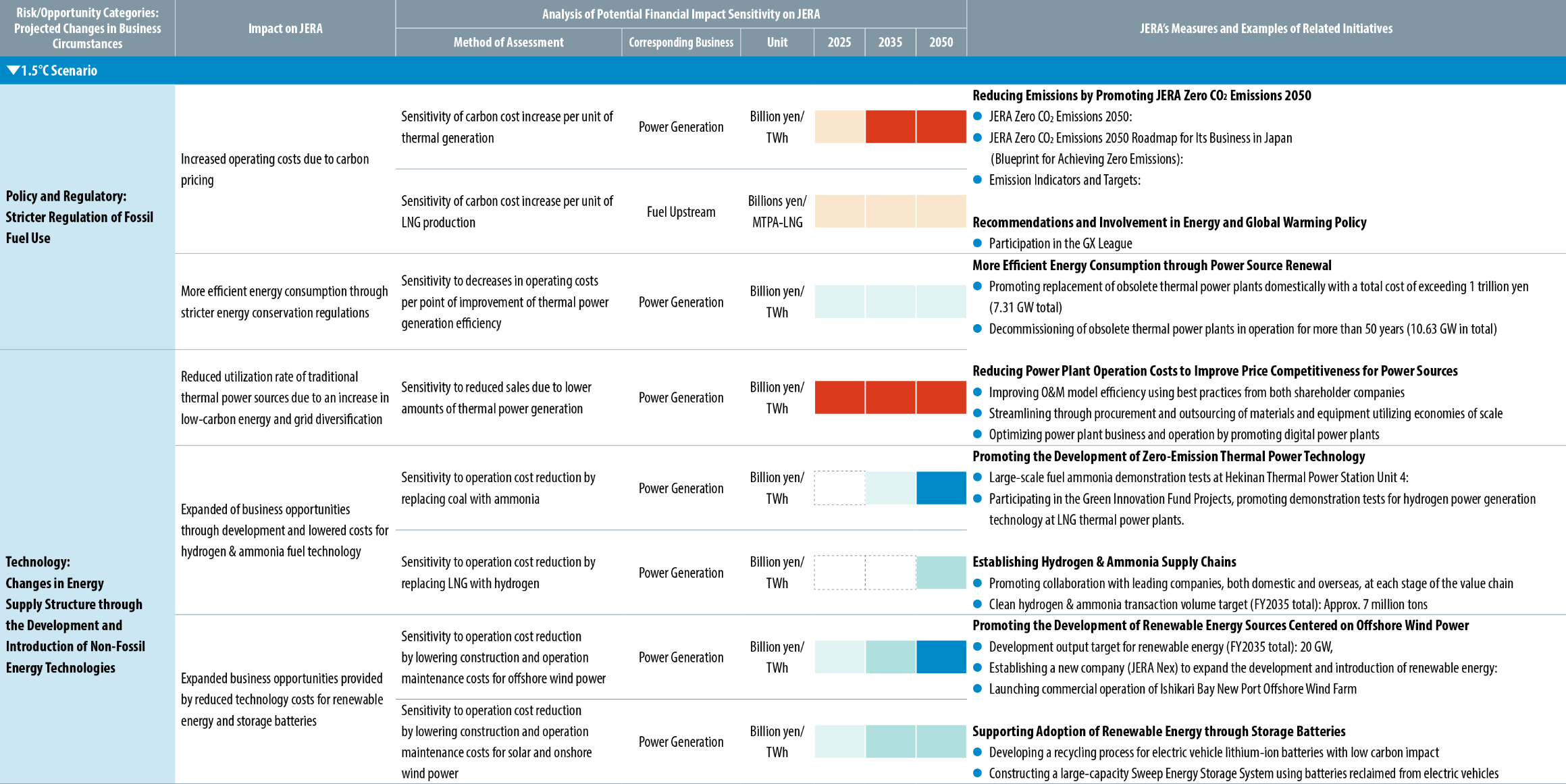

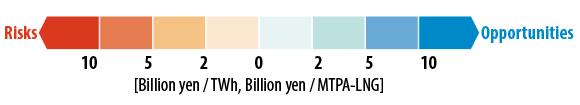

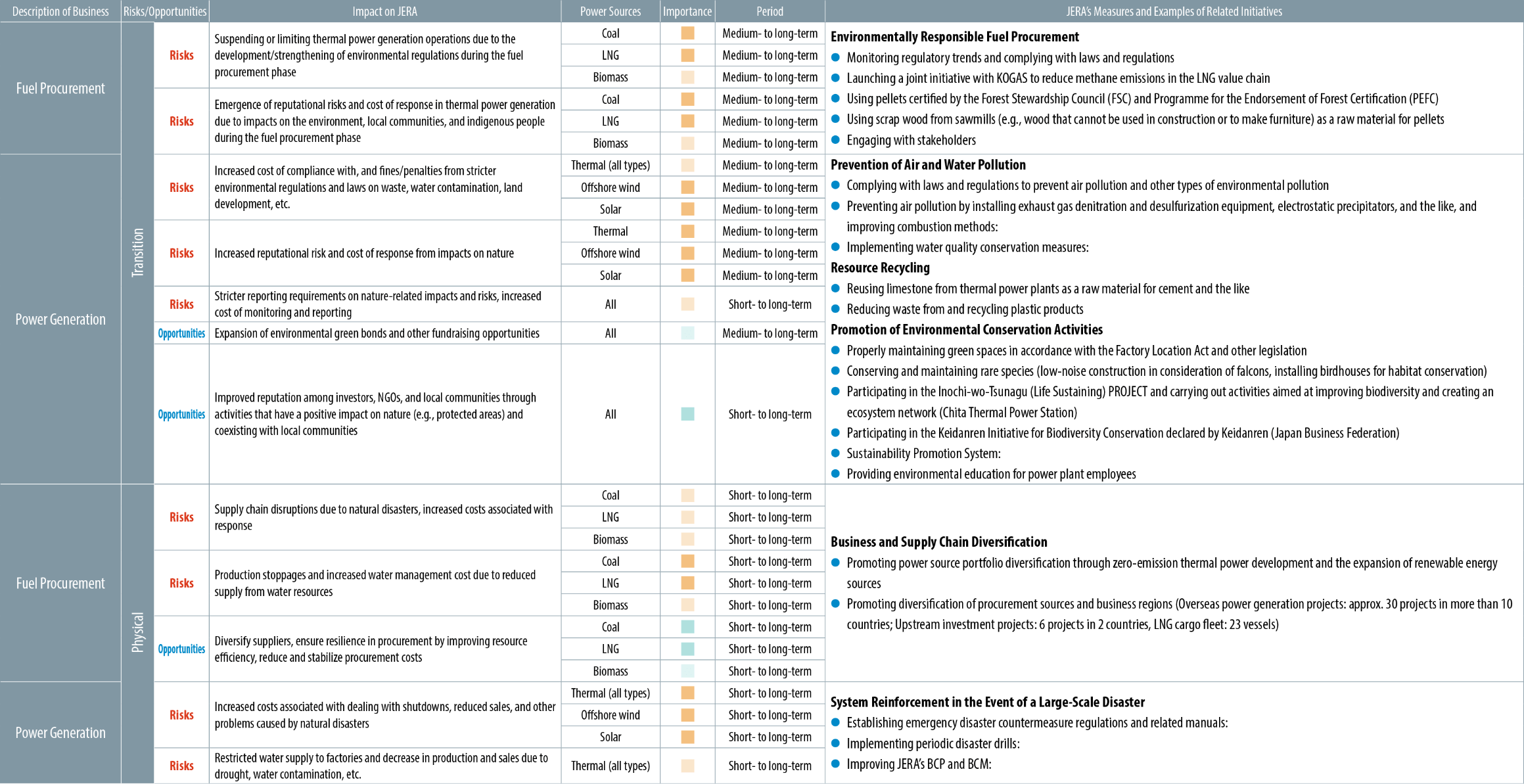

We listed climate change–related risks and opportunities for our business based on the scenarios on the previous page. We conducted a sensitivity analysis of the potential financial impact on JERA regarding the major risk and opportunity factors identified. The legend on the right side is classified into four colors that indicate the financial impact per unit of activity over the short-term (through 2025), medium-term (2026–2035), and long-term (2036–2050) periods for each risk and opportunity.

We will work to reduce the risks and seize the opportunities through JERA Zero CO2 Emissions 2050 as well as other efforts and measures.

Assessment of Impact on Our Business: A Deep Dive into the 1.5°C Scenario

In light of the steady progress we have made in our business toward achieving JERA Zero CO2 Emissions 2050 since announcing it in October 2020, and due to changes in business circumstances, we formulated a new long-term vision for 2035, unveiling a set of new environmental targets for achieving the new vision: JERA Environmental Target 2035. We will update the JERA Zero CO2 Emissions 2050 Roadmap for its Business in Japan based on the new targets and present our updated plan for introducing hydrogen & ammonia conversion in Japan.

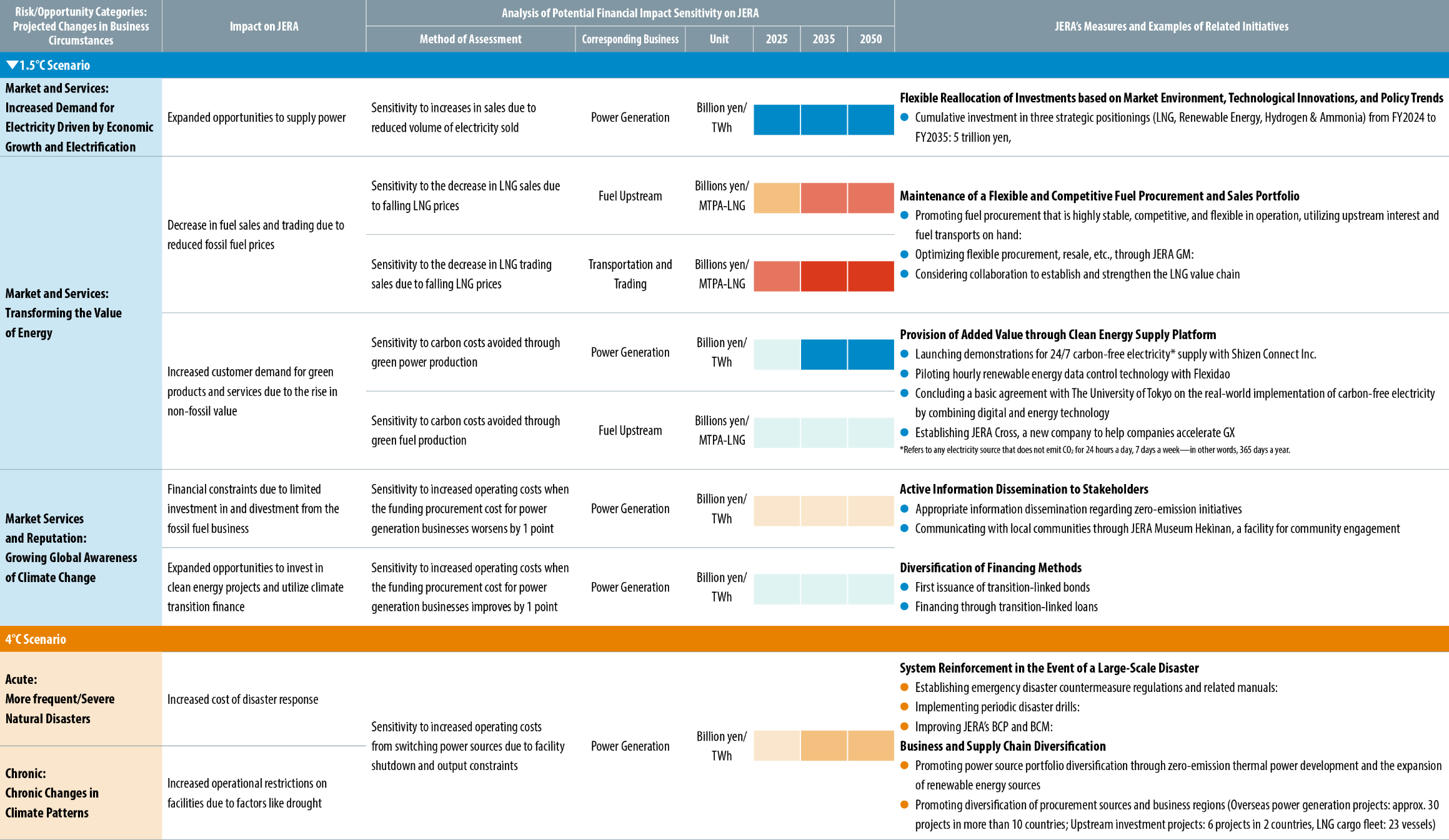

As with the previous deep dive into scenario analysis in line with the TCFD Recommendations in FY2023, we analyzed the financial impact on JERA, targeting the introduction of ammonia into our power generation business ahead of technology development, assuming the 1.5°C scenario and the upstream plan for introducing ammonia in Japan.

Our analysis revealed potential cost advantages on the order of 200 billion yen per year by 2040 and 500 billion yen per year by 2050 compared to the scenario in which we continue using coal.

We will continue to proactively develop large-scale fuel ammonia power generation technology and other decarbonization technologies in addition to devoting energy to ensuring the economic viability of the technologies so that they can help the world move away from carbon as a source of energy.

Cost Benefit Assessment of Introducing Ammonia*

- All figures are calculated based on assumed parameters (e.g., reference scenarios). Actual cost-effectiveness might differ as business circumstances change. The sizes of the circles in the graph illustrate ammonia amounts. Hydrogen is not included in the scope of this impact assessment. The plan for introducing hydrogen is provided here for reference.

Strategies for Natural Capital

We adopted the LEAP approach advocated in the TNFD disclosure framework to ascertain the relationship between the dependencies and impacts of our business on nature and assess risks and opportunities.

Locating Our Interface with Nature

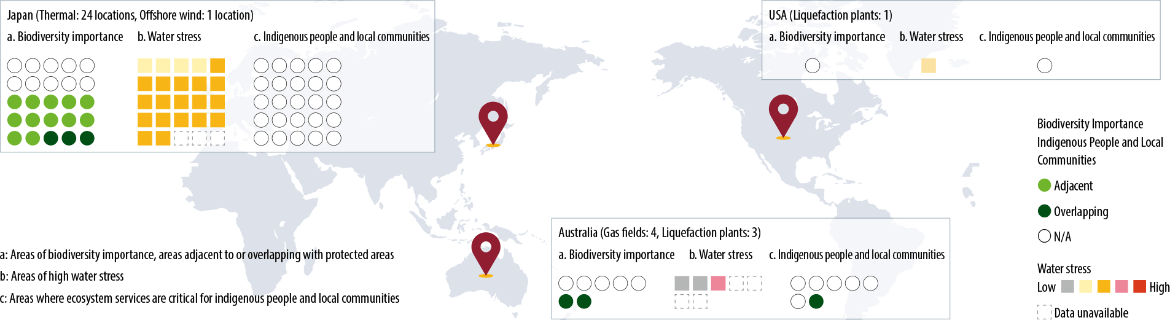

In the L (Locate) stage of LEAP, we used IBAT*1 and other tools to identify whether our business locations are in areas susceptible to the impacts of natural capital and biodiversity. We set the scope of evaluation to upstream LNG fuel development business and thermal and offshore wind power generation business in our value chain.

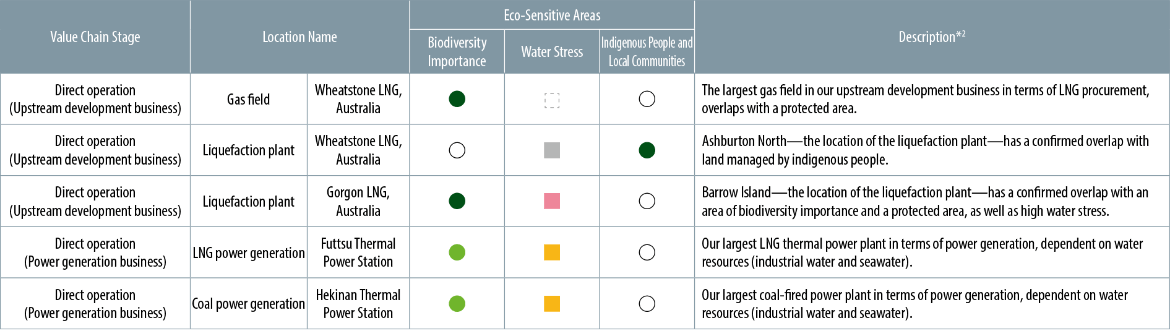

Areas Identified as High-Stress/Critical at Each Location

In addition to the results from IBAT and other analytical tools, we identified five priority locations warranting special consideration given the operating status of facilities and the actual usage of natural capital (especially water resources) at each location. We will continue to take proper measures in accordance with laws and regulations and engage with our stakeholders.

- IBAT: A biodiversity assessment tool developed by the International Union for Conservation of Nature (IUCN) and others.

- We used tools to analyze the integrity and rapid degradation of ecosystems, and took the results into account when identifying priority areas.

Analyzing Dependencies and Impacts

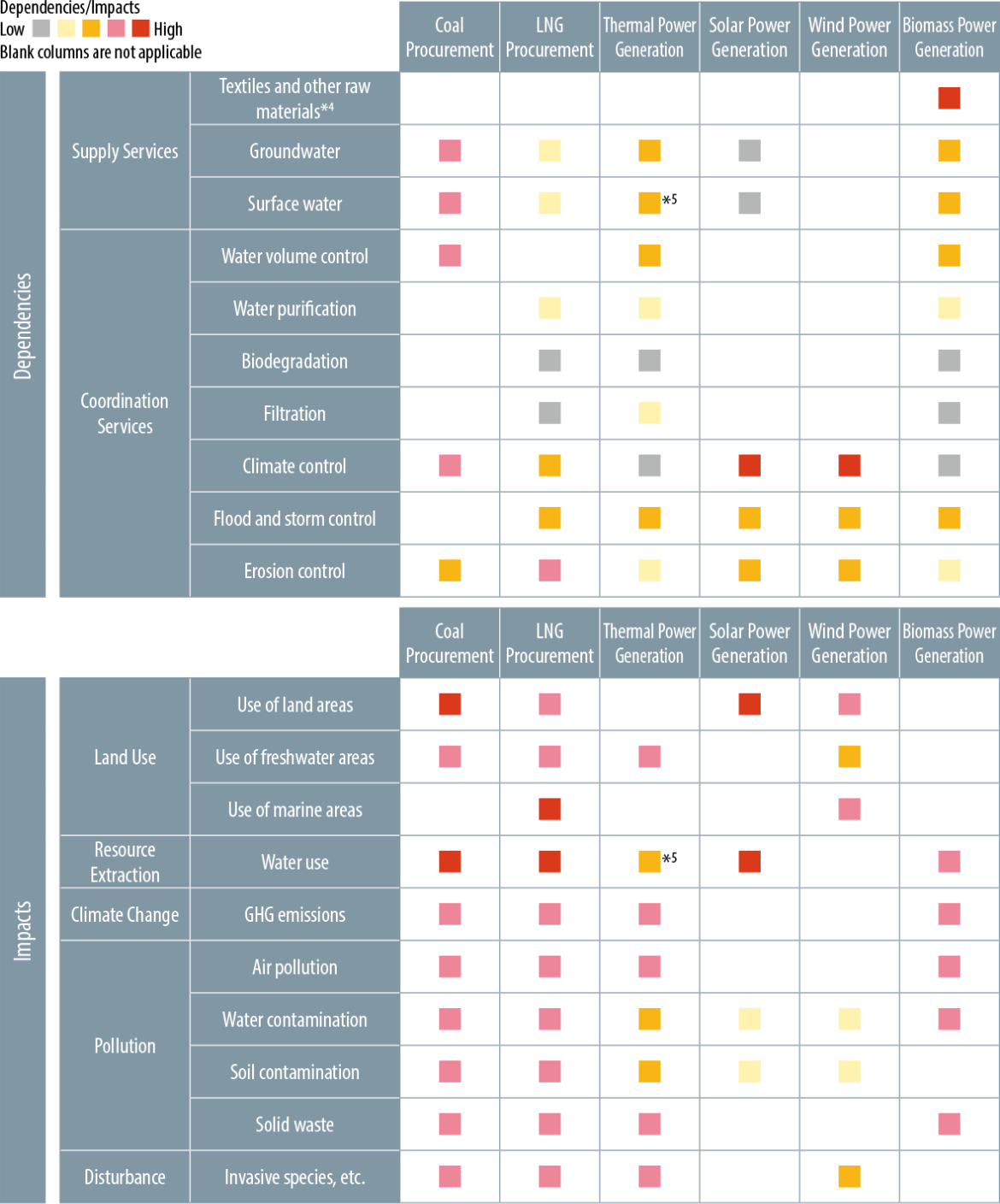

In the Evaluate stage of LEAP, we used ENCORE*3 to elucidate the relationship between the dependencies and impacts of our value chain on nature. With ENCORE, we can select the relevant business or production process and analyze its dependencies and impacts on nature in five levels.

- 3 ENCORE: An analytical tool for visualizing how business activities depend on and could impact nature, developed jointly by the United Nations Environment Programme World Conservation Monitoring Centre (UNEP-WCMC), financial institutions, and others. The analysis is based on data as of March 2024.

- 4 Refers to textiles and other raw materials derived from plants and animals; does not include fossil fuels.

- 5 Although the ENCORE results indicated "Very High" dependency on rivers, other surface water and the impact on water use for thermal power generation, we consider it to be "Moderate" based on actual usage in the context of our business.

Assessing Risks and Opportunities and Preparing to Take Action

In the Assess and Prepare stages of LEAP, we exhaustively identified nature-related risks and opportunities in our business based on the results of dependencies and impacts on nature from the Evaluate stage. We divided the risks and opportunities into three time frames: short-term (through 2025), medium-term (2026–2035), and long-term (2036–2050). In addition, we evaluated importance to our business based on the likelihood of occurrence and magnitude of the risks and opportunities.

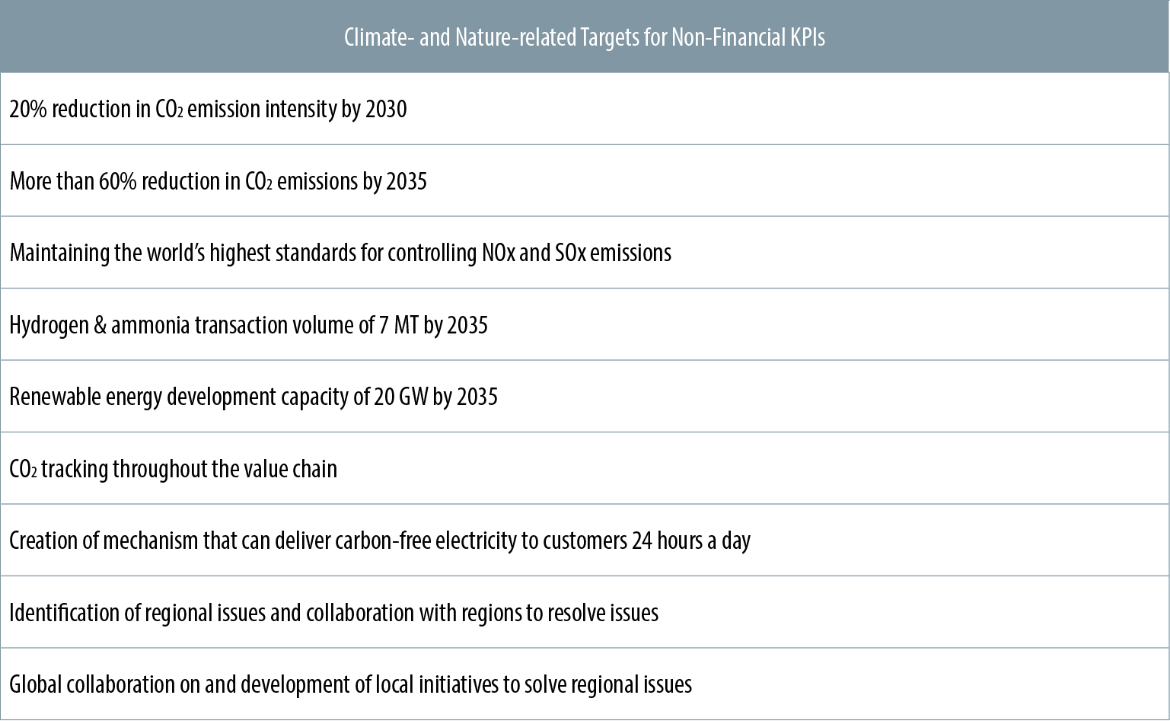

Metrics and Targets

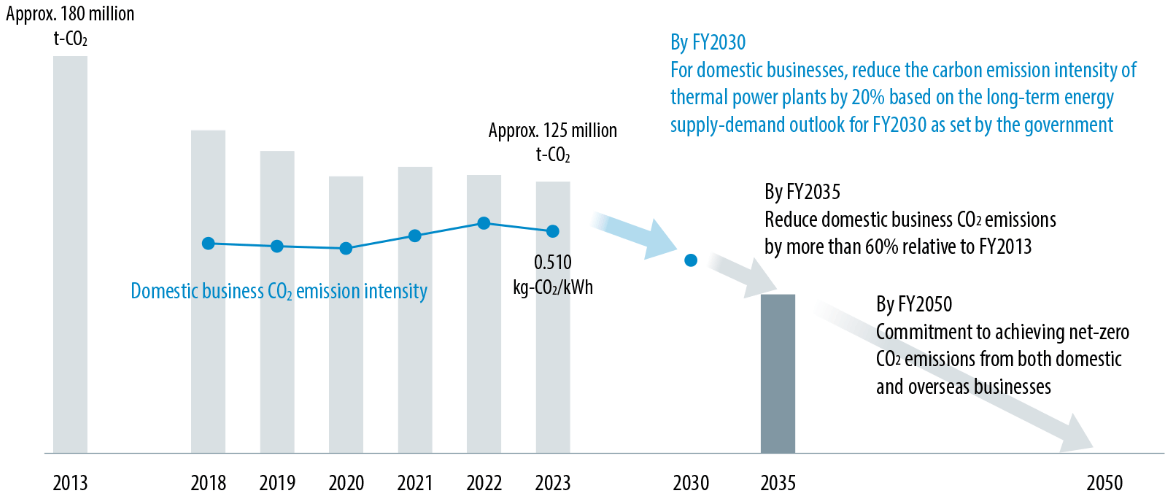

We view JERA Zero CO2 Emissions 2050 as a long-term goal and have developed a roadmap for achieving it as well as interim targets for CO2 emission intensity by 2030 and CO2 emissions by 2035. In addition, we continue to calculate and assess actual results each year to manage our progress. We have also formulated the JERA Group Sustainability Policy and expanded non-financial KPIs for 2024. We will continue to promote initiatives toward sustainable management.

Domestic Business CO2 Emissions