Performance highlightsInvestor Relations

JERA has set management goals related to profitability, capital efficiency, growth, and financial soundness, aiming for specific outcomes by FY2025 (announced in May 2022) and for target levels by FY2035 (announced in May 2024), and we are makingprogress on various initiatives to meet these objectives.

In addition, with a fundamental emphasis on safety, we shall expedite our ESG and sustainability efforts, which include promoting the active participation of a diverse and inclusive workforce (D&I) and strengthening corporate governance, all while ensuringa stable supply of electricity. We aim to realize medium- to long-term decarbonization, thereby pursuing disciplined growth and maximizing corporate value. We have voluntarily adopted the International Financial Reporting Standards (IFRS) from theconsolidated financial statements for the annual reporting of FY2022, and the figures for FY2021 have also been modified in accordance with the IFRS.

Financial Information

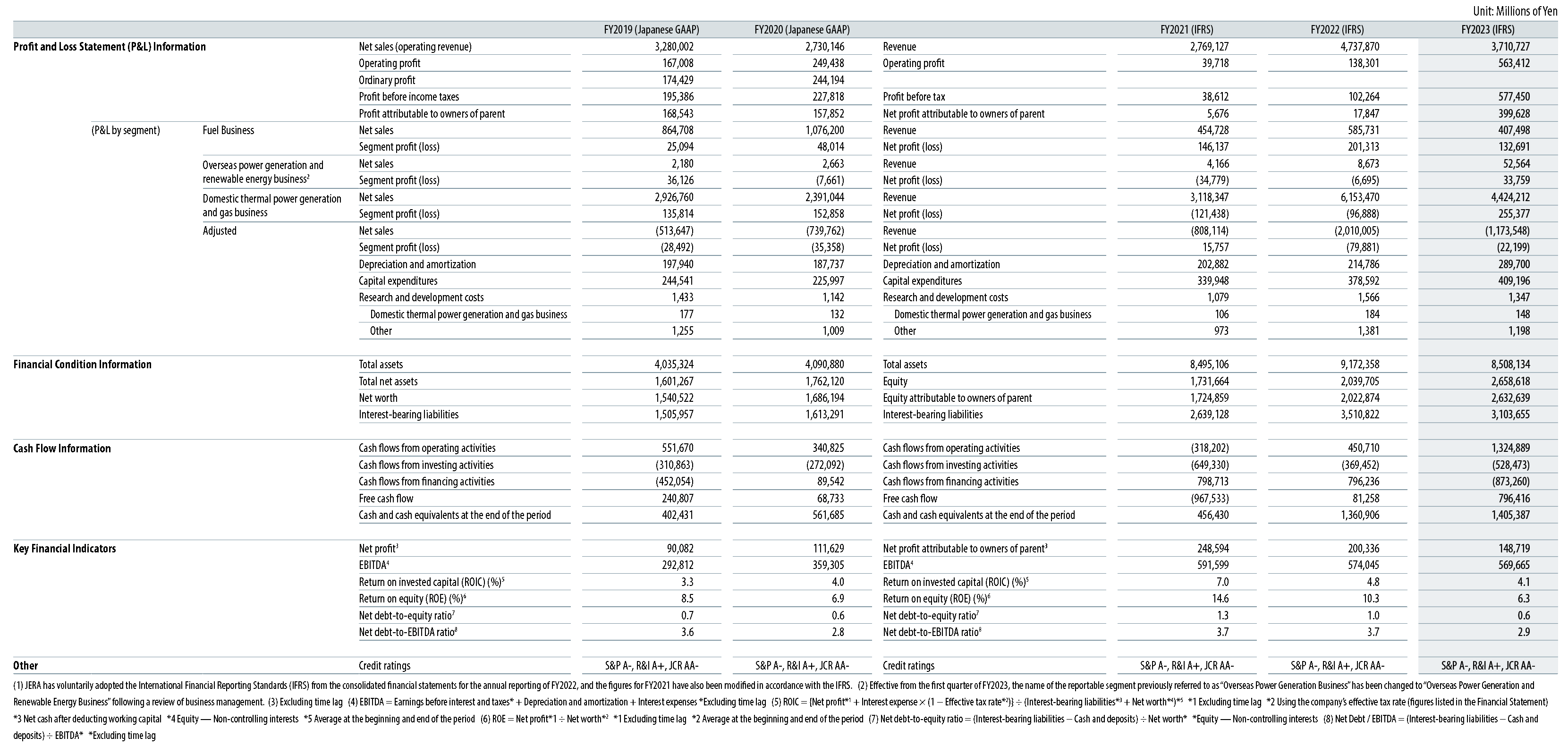

Revenue

Revenue for FY2023 was 3,710.7 billion yen, a decrease of 1,027.1 billion yen (-21.7%) from the previous year, due tofactors such as a decline in the volume of electricity sold.

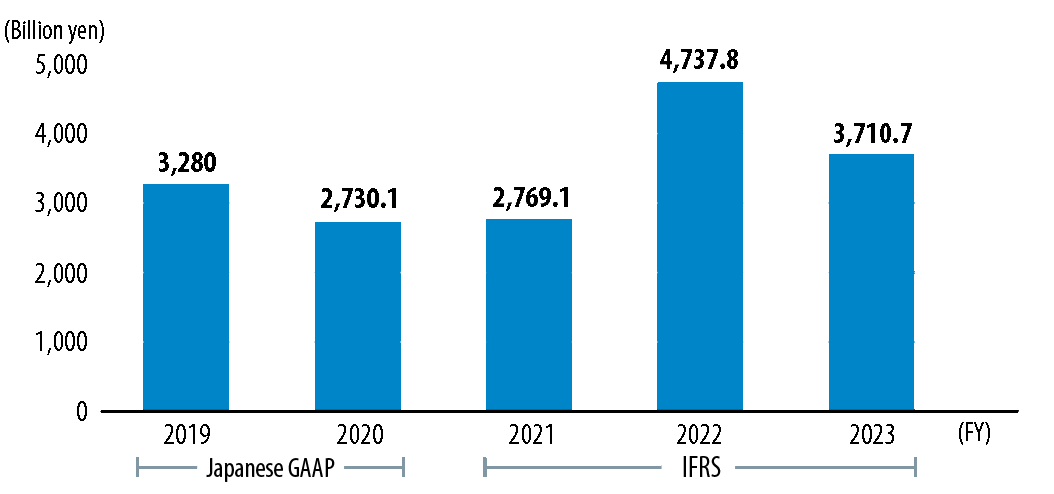

Profit Attributable to Owners of Parent (including/excluding time lag)

Net profit for FY2023, excluding time lag, decreased despite increased profits from the overseas power generation andrenewable energy business and improvements in valuation gains and losses on coal and other contracts at the end of theperiod. This decrease was due to factors such as the impact of fuel procurement prices, the unit cost of fuel inventory atthe beginning of the period, and a decline in profits from the fuel business.

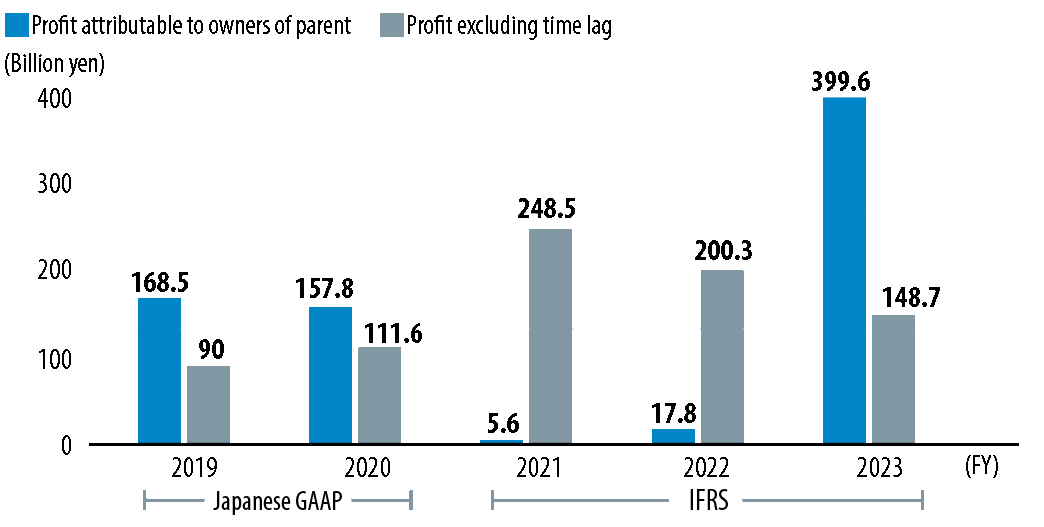

EBITDA

In FY2023, EBITDA remained high due to increased depreciation and amortization and interest expenses, despite adecrease in pre-tax profit compared with the previous year.

EBITDA = Earnings before interest and taxes* + Depreciation and amortization + Interest expenses

- Excluding time lag

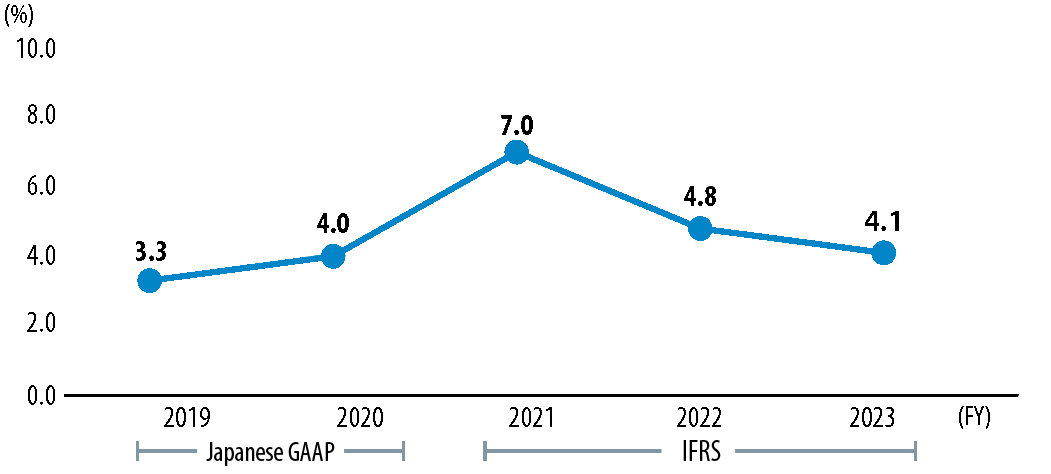

ROIC

The main reason for the decrease in income in FY2023 compared with the previous year was a decrease in net income, excluding time lag.

ROIC = {Net income*1 + Interest expense × (1 − Effective tax rate*2)} ÷ (Interest-bearing liabilities*3 + Net worth*4)*5

- Excluding time lag

- Using the company's effective tax rate (figures listed in the Financial Statement)

- Net cash after deducting working capital

- Equity — Non-controlling interests

- Average at the beginning and end of the period

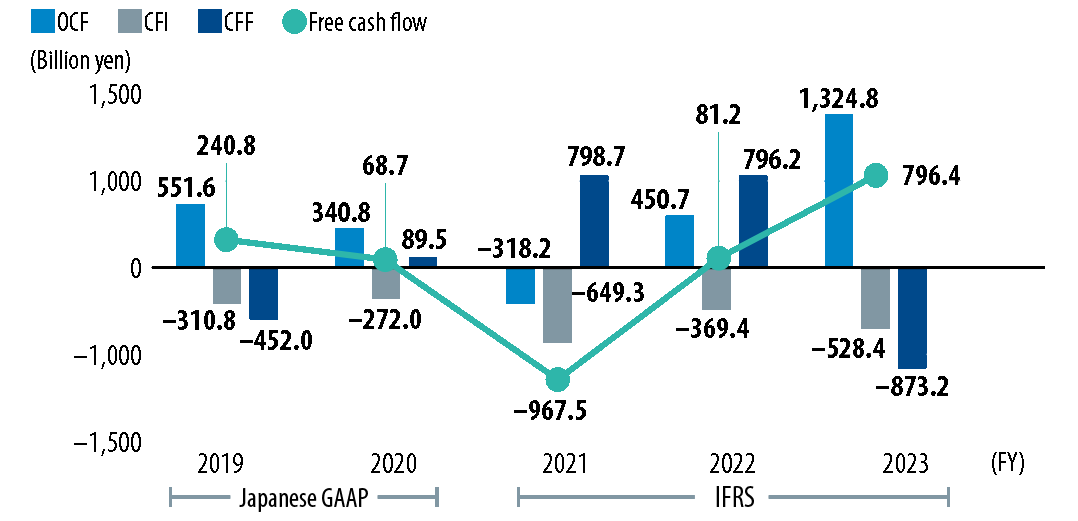

Cash Flows from Operating, Investing, and Financing Activities (CF) / Free Cash Flow

In FY2023, operating cash flow increased by 874.1 billion yen compared with the previous year, driven by factors such as an increase in pre-tax profit due to the improvement of time lag-related gains and losses, as well as decreases in accounts receivable and inventory. Investment cash flow increased by 159 billion yen compared with the previous year due to increased expenditures related to the acquisition of affiliated companies. Free cash flow increased by 715.1 billion yen.

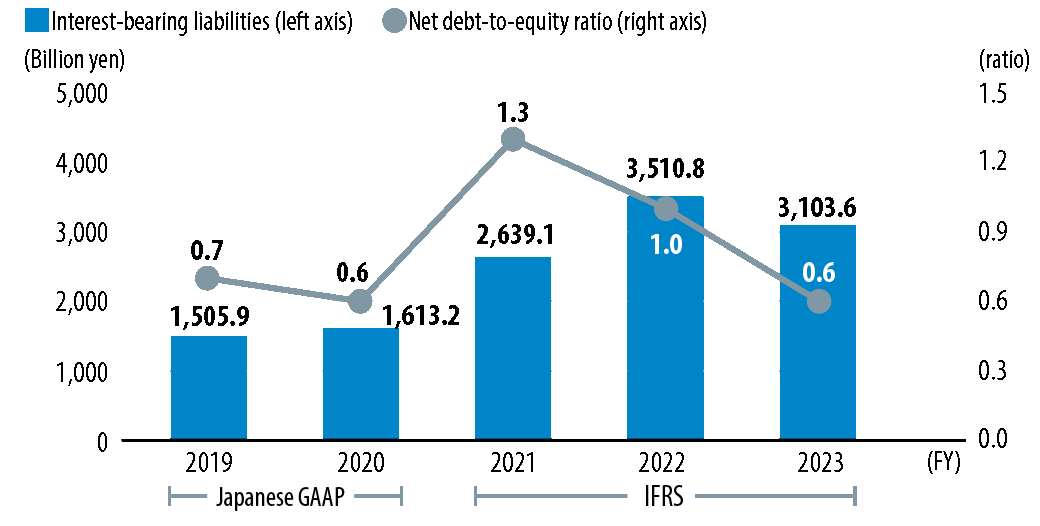

Interest-Bearing Liabilities / Net Debt-to-Equity Ratio

The balance of interest-bearing liabilities in FY2023 decreased compared with the previous year due to a reduction in borrowings. As a result, the net debt-to-equity ratio also improved by a factor of 0.6.

Net debt-to-equity ratio = (Interest-bearing liabilities − Cash and deposits) ÷ Net worth*

- Equity — Non-controlling interests

Non-Financial

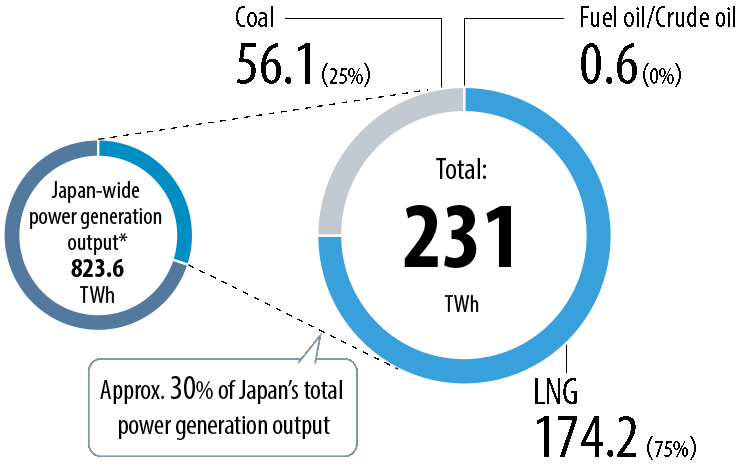

FY2023 Domestic Power Generation Output (by fuel type)

We are responsible for approximately 30% of the power generation output by domestic electric utilities. A large portion of this power generation comes from LNG, which has low CO2 emissions.

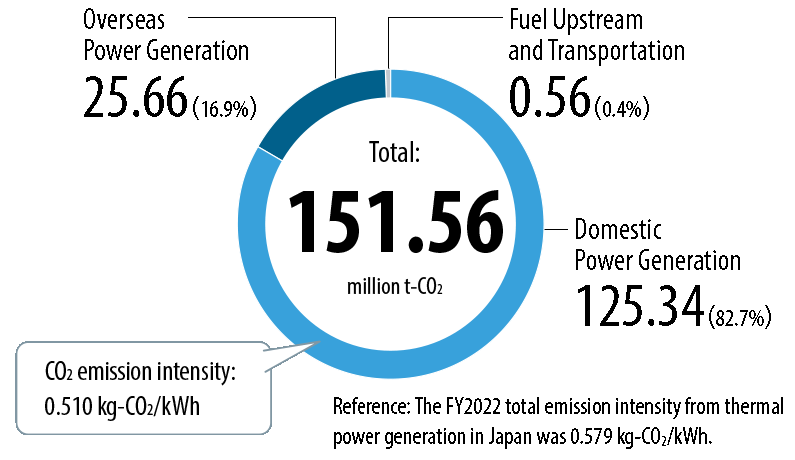

FY2023 Scope 1 CO2 Emissions / CO2 Emission Intensity (Japan)

As part of the JERA Environmental Target 2035, we aim to reduce domestic CO2 emissions relative to FY2013 by more than 60% by FY2035.

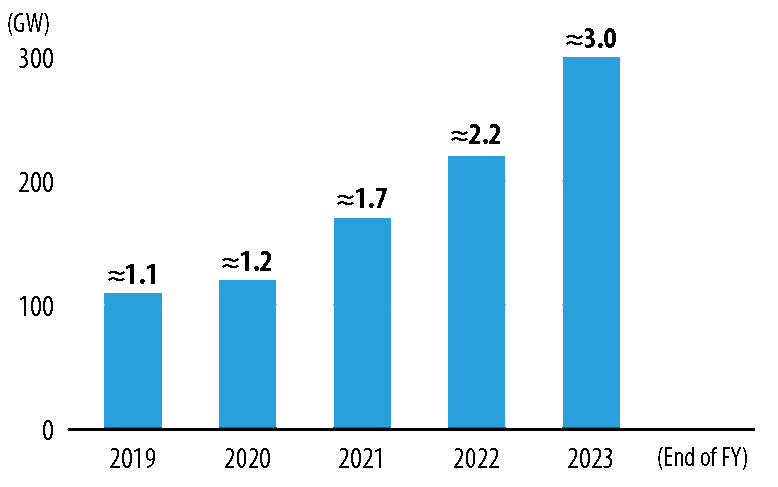

Renewable Energy Output Share

Our Center of Excellence (COE) in Europe and local teams will work closely together to develop wind and solar power projects on a global scale.

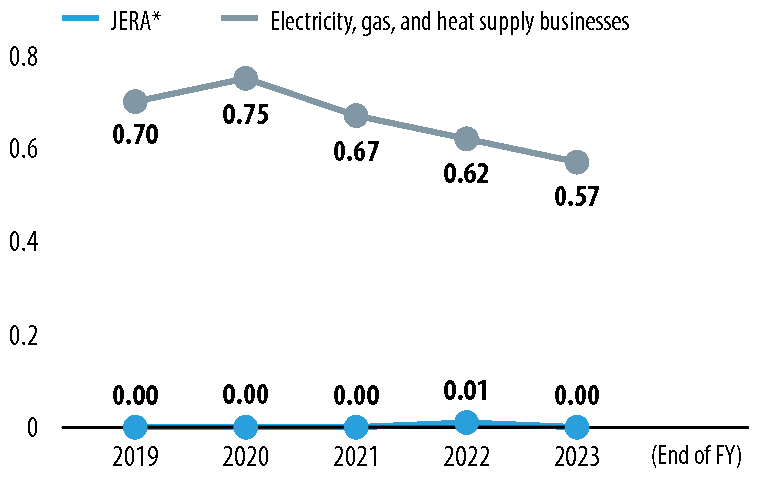

Employee Injury Frequency Rate

We are committed to company-wide efforts for safety, the bedrock of our business, with aims to eradicate occupational accidents

- JERA employees only

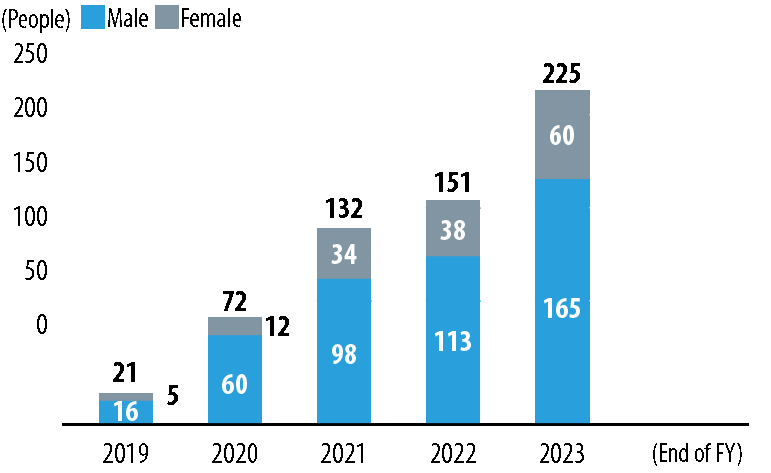

Number of Mid-Career Hires (by gender)

We are actively hiring people with diverse backgrounds and advanced expertise not yet represented at JERA. With the demand for agile matching of talent to business strategy, the number of mid-career hires is showing an annual upward trend as each business evolves.

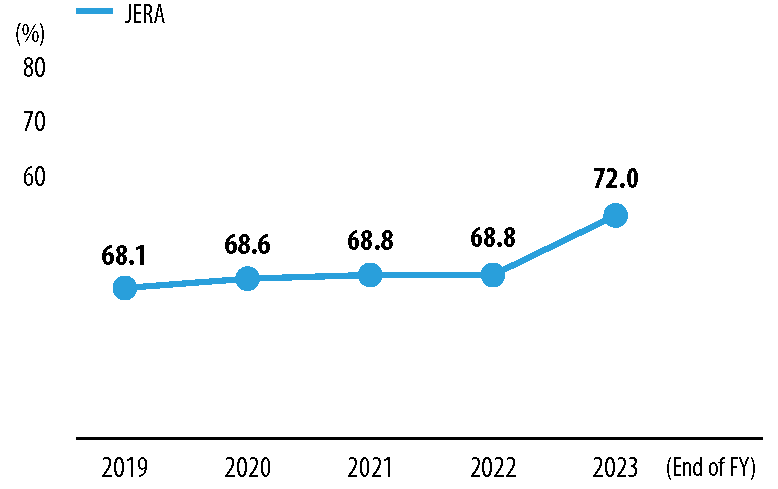

Employee Engagement Rate

We conduct employee satisfaction surveys to gain a quantitative understanding of employee opinions about their work and job fulfillment. In FY2023, the rate was 72.0%, an improvement of 3.2 points from the previous fiscal year.

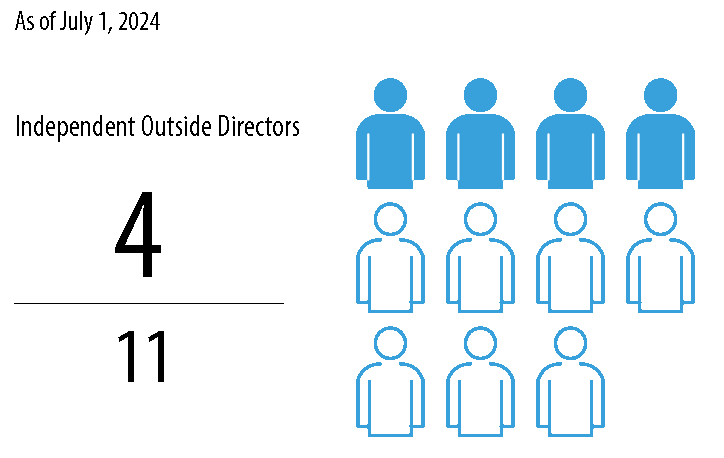

Number of Outside Directors

In addition to JERA-employed executive directors and directors who have come from our shareholder companies, we hire outside directors in order to create an autonomous and independent corporate culture and a management structure that enables fair and prompt decision-making

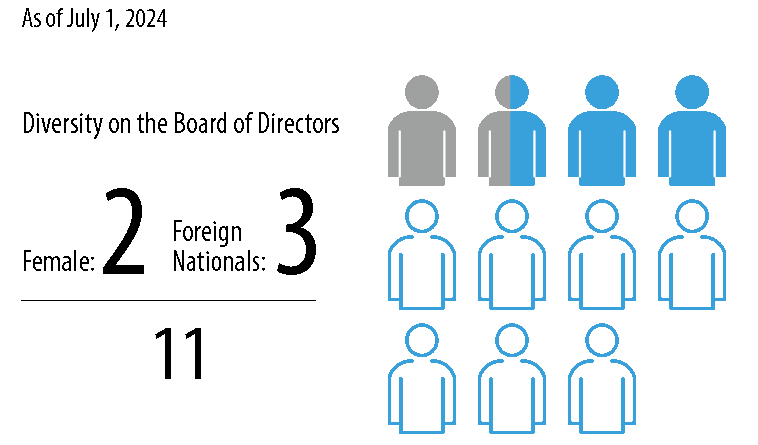

Diversity on the Board of Directors

We believe that a diverse Board of Directors leads to better business decision-making and have made efforts to appoint female directors and foreign nationals to the board.

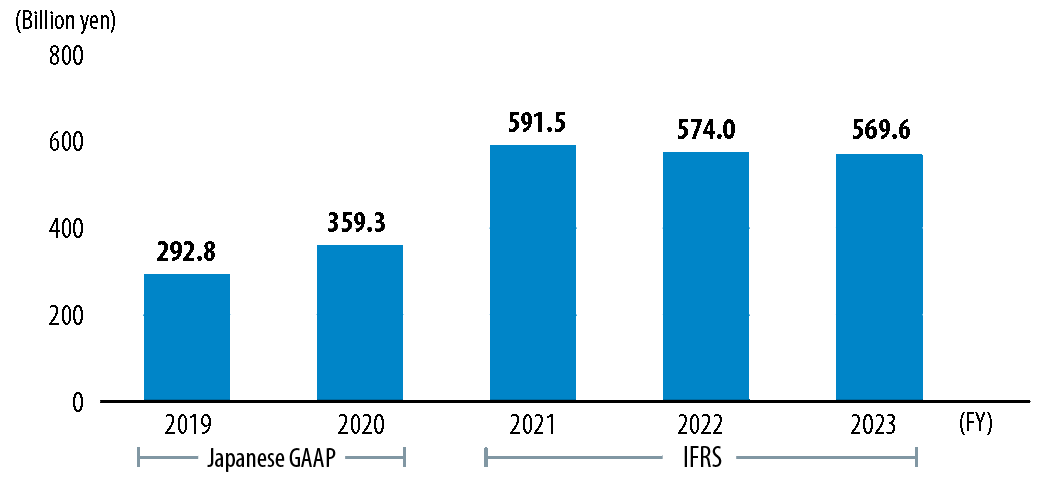

Financial Data