Message from the CFOInvestor Relations

Review of FY2024 and Toward Achieving Our Financial Targets for FY2025 and FY2035

Kazuo Sakairi

Corporate Vice President, Managing Executive Officer, Director, and Chief Financial Officer (CFO)

Net Profit

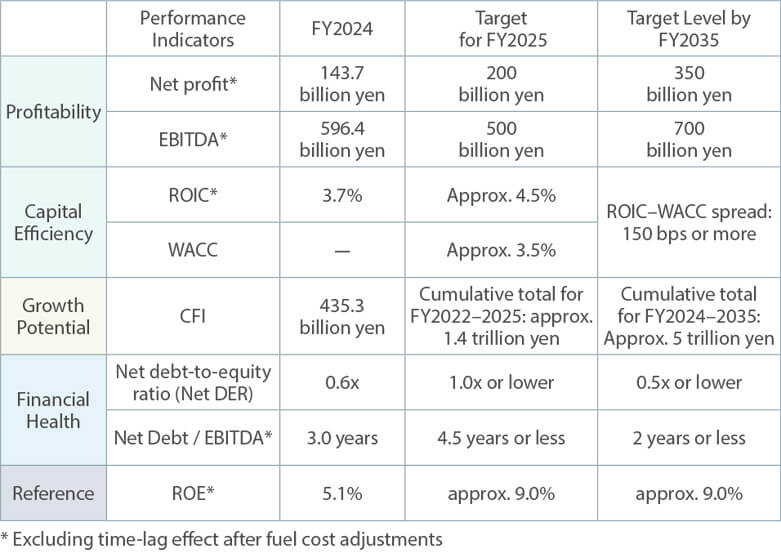

Net profit for FY2024 was 183.9 billion yen, a year-on-year decrease of 215.7 billion yen. This was due to factors such as decreased profitability in the overseas power generation and renewable energy business and in the fuel business, despite improvements in the fuel procurement price and impacts of fuel inventory unit price. (Excluding the time lag effect of fuel cost adjustments, net profit was 143.7 billion yen, down 4.9 billion yen year on year.) For FY2025, we anticipate recovery from the impact of the fire incident on the domestic thermal power generation and gas business and expect increased earnings in the overseas power generation and renewable energy business. We assess that we are on track toward our consolidated net profit target of 200 billion yen (excluding time-lag effects). We will also continue to advance initiatives toward achieving our net profit target of 350 billion yen by FY2035.

Balance Sheet Management

In FY2024, interest-bearing liabilities remained flat year on year at around 3.1 trillion yen, while capital rose by approximately 300 billion yen to about 3 trillion yen, reflecting higher retained earnings and an increase in foreign currency translation adjustments. As a result, Net DER, a key indicator of financial health, remained at 0.6x, the same as the previous fiscal year, and is at a level that achieves our FY2025 target of 1.0x or below.

ROIC, an indicator of capital efficiency, declined from the previous fiscal year due in part to capital increase from foreign currency translation adjustments. Nevertheless, we are pursuing initiatives such as improving profitability to achieve our FY2025 target of 4.5% and our FY2035 target of an ROIC–WACC spread of at least 150 bps (as described below).

Capital Allocation

In the "Financial Strategy and Financial Target Levels Targeted for by 2035" announced last year, we set out our future approach to capital allocation. As we aim to build a company capable of sustainable growth, we plan to invest a cumulative total of 5 trillion yen between 2024 and 2035 in three strategic business areas: LNG, renewable energy, and hydrogen and ammonia. The allocation will be adjusted flexibly based on careful assessment of external conditions and other factors.

Achieving High Capital Efficiency and a Robust Financial Base Recognized by Capital Markets

Drawing on the future capital allocation outlined in the "Financial Strategy and Financial Target Levels Targeted for by 2035" we will advance the agile optimization of our portfolio structure and balance sheet, reflecting changes in the external environment and the outlook for energy supply and demand.

Recognizing the difficulty of forecasting medium- to long-term changes in the business environment, we have chosen not to set a fixed numerical target for ROIC. Instead, by referencing benchmarks from overseas utilities and listed energy companies, we aim to enhance capital efficiency with a strong awareness of the cost of capital, and have established a KPI of achieving a ROIC–WACC spread of at least 150 bps by FY2035. By achieving these KPIs, we aim to enhance corporate value on a sustainable basis.

Corporate Value Structuring (On Pre-Financial Value)

Through discussions at the Sustainability Promotion Committee and other meetings, we have clarified that enhancing corporate value consists of the maximization of short-term free cash flow, the improvement of medium- to long-term free cash flow growth, and the reduction of the cost of capital.

We have illustrated that the measures based on our growth and financial strategies not only create financial value directly, but also generate pre-financial value through supporting activities, which will ultimately translate into financial value.

Specifically, among the material issues that JERA has identified as critical, the foundational material issues that underpin our business strengthen pre-financial capital. This contributes to the improvement of potential growth capacity, the enhancement of non-price competitiveness, and risk reduction. We demonstrated that this sequence of initiatives, taken together, ultimately leads to financial value―specifically, the improvement of free cash flow growth over the medium to long term and the reduction of the cost of capital.

Through this initiative, we hope stakeholders both inside and outside the company will recognize that all of JERA's initiatives contribute to enhancing corporate value, and that the work of each individual employee is the very source of value creation. At the same time, we aim to use this initiative as an opportunity to enhance the quality of communication with stakeholders and to strengthen engagement.

Flat and Innovative Culture

Continuous Innovation

JERA never ceases to seek opportunities for growth. As CFO, I would like to share two examples of initiatives through which we are consciously embedding innovation. The first is JERA Ventures, our corporate venture capital (CVC) initiative established in 2023. As global energy challenges evolve and uncertainty increases, open innovation with startups, major corporations, and academic and research institutions is essential to our continuous delivery of cutting-edge solutions. JERA Ventures serves as a catalyst behind this initiative, investing in and collaborating with startups possessing advanced technologies and business models in three domains: (1) decarbonization to realize clean energy, (2) digital solutions that deliver new value to customers, and (3) well-being initiatives that contribute to enhancing quality of life for all JERA Group employees. We established a total investment framework of 300 million USD (approx. 45 billion yen) and, in the two years since its launch, have invested in eight startups. Through the adoption of new technologies and business models, we have aimed to generate synergies between these startups and JERA.

Looking ahead, we will work with internal and external stakeholders to develop mechanisms for co-creation business hypotheses and to create opportunities for small-scale demonstration experiments with technology startups. We will also focus on developing the innovative talent that will drive the next generation of the JERA Group by providing opportunities to explore new fields in collaboration with startups, thereby accelerating JERA's sustainable growth in terms of both innovation and organizational strength.

Town Hall

One last thing―as CFO, my mission is to foster an open and flat culture through a variety of approaches. Since its establishment, JERA has grown significantly in both scale and number of employees, yet I still make it a priority to create as many opportunities as possible to talk directly with individual employees. I have already hosted more than 200 small-group lunches in my office to date, and I also hold semi-annual CFO town halls to ensure I hear directly from younger employees. The town hall brings together younger employees from the head office, business divisions, overseas offices, and power plants to foster mutual understanding across divisions and to discuss the directions and challenges JERA should pursue in the future. These sessions provide many candid and insightful opinions from this employee demographic. These direct dialogues have been a source of great inspiration for me, and they prompt me each day to consider how employees' voices can be meaningfully reflected in our decision-making. I also hope that every one of my early- and mid-career colleagues―the ones responsible for the next generation of JERA―will embrace the opportunity to help shape a stronger, more attractive organization, while pursuing self-improvement and aspiring to become experts in their respective fields.