Corporate GovernanceSustainability

- Fundamental Approach

- Issue Awareness

- Governance System

- Roles, Responsibilities, and Diversity of the Board of Directors

- Key Deliberations of the Board of Directors

- Leadership Panel and Expert Committees

- Role of the Nomination and Compensation Committee and Its Discussion Topics

- Strengthening of JERA Group Governance

- Support for Directors

- Compensation Structure for Officers

- Evaluating Board Effectiveness

Fundamental Approach

Our fundamental corporate governance philosophy is to maintain a strong and sound management and financial structure trusted by the international energy market while ensuring an autonomous and independent corporate culture and a management system that allows us to make fair and prompt decisions.

Toward this end, we established our Corporate Governance Guidelines in October 2019 for building and implementing an appropriate corporate governance system and are continuously working to strengthen and enhance it.

Issue Awareness

To achieve sustainable corporate growth and enhance corporate value over the medium to long term, companies must implement corporate governance to support accurate decision-making by management. The environment surrounding our company is changing rapidly amid the acceleration of global trends toward energy security and decarbonization. As this happens, we are expected to work on various governance issues with a sense of urgency through such means as facilitating a better functioning Board of Directors, empowering diverse talent, and enhancing initiatives to address issues related to sustainability.

We will strive to continuously enhance governance to earn the trust of our stakeholders.

- These guidelines set out our fundamental approach to and system for our corporate governance and serve as a code of conduct for our officers in pursuit of sustainable growth and enhancement of corporate value.

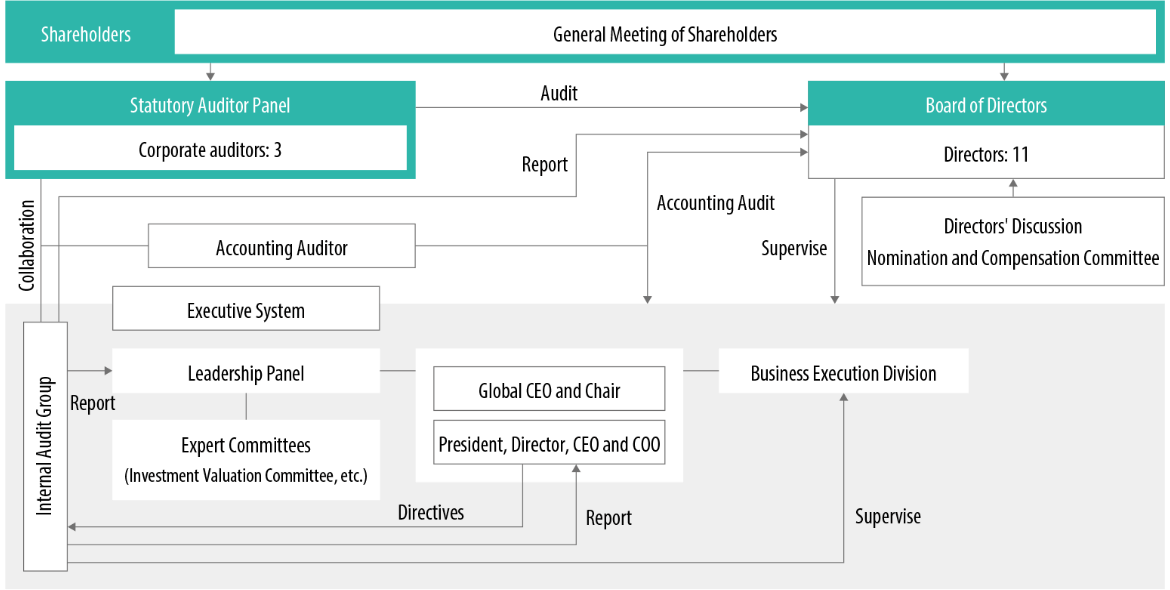

Governance System

In order to expand business throughout the world in a wide range of fields, the Board of Directors—consisting of directors from JERA who are intimately familiar with our business and outside directors who bring a wealth of insights— make material business decisions and supervise the execution of business operations. Furthermore, JERA has corporate auditors as independent officers who are responsible for auditing the execution of the Directors’ duties. In addition, we have established the Statutory Auditor Panel to ensure effective communication among the corporate auditors. This panel facilitates the exchange of opinions and provides relevant information on audits, management, business, and other related matters.

We have also adopted a system in which executive officers are responsible for business execution based on the decisions made by the board. This separates important decision-making and supervision of management from business execution and produces accurate, prompt decision-making and efficient business execution.

Corporate Governance Structure

(as of July 1, 2024)

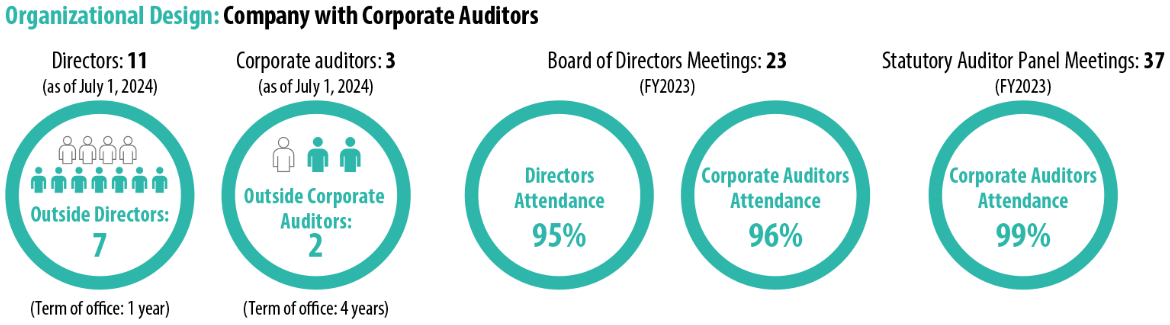

Overview of Corporate Governance

Roles, Responsibilities, and Diversity of the Board of Directors

The Board of Directors makes decisions on management targets, business strategies, and other important management matters based on applicable laws and regulations, our Articles of Incorporation, and our internal rules. It also supervises the execution of business operations.

In addition, we believe that in order to expand our business throughout the world in a wide range of fields, we will have to respond quickly and appropriately to the business environment and ensure the objectivity and soundness of our decisions. As such, in addition to directors who work for JERA, we hire independent outside directors to ensure diversity of knowledge, experience, and other attributes among the board. The Board of Directors, chaired by Yukio Kani, Global CEO and Chair, ensures that the proceedings are conducted smoothly and effectively.

Key Deliberations of the Board of Directors

The Board of Directors generally convenes once a month and is responsible for formulating JERA’s basic management policies, including our business strategies and plans. In addition, it makes decisions on significant large-scale investments related to our strategic direction and supervises the execution of business operations. In determining basic management policies, detailed discussions are held at the Directors’ Discussion, which is attended by all our directors. This ensures that we consider a multifaceted range of opinions brought by our diverse board, adapting to the ever-changing international situation, business environment, and the roles JERA ought to play. For the oversight of business execution, we have established a reporting framework where directors responsible for business execution provide both regular and ad-hoc reports as needed. This ensures timely and accurate information sharing and appropriate response. The primary agenda items in FY2023 were as follows.

Key Discussion Points of the Board of Directors

| Category | Description |

|---|---|

| Crisis Response | Measures in response to the invasion of Ukraine and energy security |

| Management Strategies | New long-term vision, new environmental targets, financial strategy, new management goals, growth strategy, and safety measures |

| Regional Strategies | Regional business strategies across the globe |

| Decarbonization Strategy | Development of a for zero-emission thermal power and the establishment of a hydrogen & ammonia value chain |

| Investment Decisions | Business investments and M&A decisions in Belgium, the United States, and Japan, as well as in countries throughout Asia and other regions |

Leadership Panel and Expert Committees

We have established the Leadership Panel, which consists of the Global CEO and Chair, the President, Director, CEO and COO, and C-suite executives and officer, as a forum for deliberating on and deciding important management matters and receiving necessary reports based on the company’s internal rules.

Moreover, expert committees have been established as subsidiary bodies to the Leadership Panel—in principle, one for each major field—to provide advice to the Leadership Panel from an expert perspective and support its deliberations. In principle, matters to be proposed and reported to the Board of Directors are discussed and decided by the Leadership Panel based on advice from the relevant expert committees. The results of deliberations by the Leadership Panel are reported to the Board of Directors, along with advice from the expert committees.

Role of the Nomination and Compensation Committee and Its Discussion Topics

We have established the Nomination and Compensation Committee, which comprises three or more directors, including two outside directors. The Committee is formed to discuss matters related to the appointment and compensation of directors and executive officers. In FY2023, the Nomination and Compensation Committee met eight times. Attendance details for each of these meetings are as follows:

Nomination and Compensation Committee Attendance*

| Position | Name Meetings | Attended |

|---|---|---|

| Global CEO and Chair | Yukio Kani | 8 of 8 meetings |

| President, Director, CEO and COO | Hisahide Okuda | 8 of 8 meetings |

| Outside Director | Satoru Katsuno | 8 of 8 meetings |

| Outside Director | Daisuke Sakai | 6 of 6 meetings |

- The above officers and their positions are as of the end of FY2023.

- The attendance details for outside director Daisuke Sakai cover the Nomination and Compensation Committee meetings from his appointment in June 2023 onward.

Specific matters examined by the Nomination and Compensation Committee include the appointment, roles, and responsibilities of directors and executive officers, as well as the setting of compensation amounts, which are then separately approved by the Board of Directors.

Strengthening of JERA Group Governance

We are committed to developing a group company management system with the aim of creating lasting corporate value for our Group. We respect the business traditions of our group companies in their respective countries and support swift and autonomous decision-making while granting appropriate authority and management resources. In accordance with this approach, we have adopted a resolution on an internal control structure to ensure appropriate business operations across the group. The JERA Group Compliance Policy and JERA Group Compliance Code of Conduct ensure we can provide appropriate support to group companies so that they can autonomously develop and operate structures suitable to their business. We have implemented framework agreements with our group companies and established mechanisms to determine compliance requirements for consulting, reporting, and monitoring activities. Specifically, by clarifying responsibilities and authority through internal rules, we strive to enable our group companies to make efficient decisions and conduct business activities swiftly and appropriately. In accordance with the Affiliate Management Regulations, JERA has established a system for prior consultation and reporting from group companies on important matters concerning consolidated management. In addition, to review management matters, including legally required actions and critical risks related to group management, we conduct regular and periodic monitoring of our group companies.

Support for Directors

We have established a system that provides directors with the support they need to perform the duties expected of them. Among other benefits, the system provides each director with comprehensive, accurate information, as well as opportunities to learn more about our company’s core businesses from outside experts around the world. We strive to provide materials to each director several days ahead of scheduled meetings. In addition, for our outside directors, we organize pre-meeting briefings and Q&A sessions regarding agenda items, ensuring that thorough deliberations can occur based on ample information, thereby optimizing the limited time allotted for discussions.

In FY2023, we covered a wide range of topics carried over from FY2022 during several discussions of key management issues. These included revisiting critical areas such as decarbonization strategies, financial strategies, and regional strategies, placing particular emphasis on safety efforts, our most critical material issue.

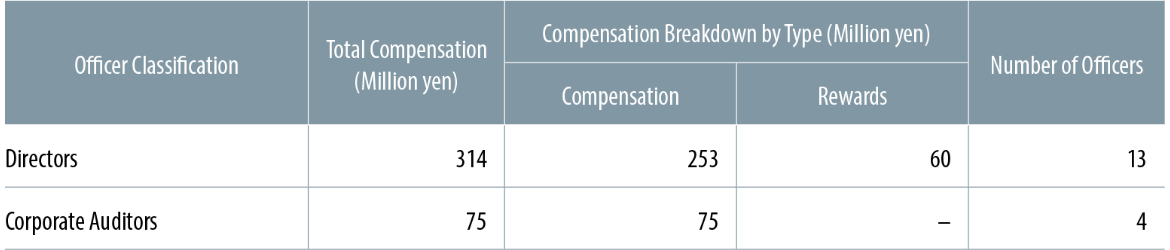

Compensation Structure for Officers

The compensation for our directors is determined within the limits approved at the General Meeting of Shareholders, based on the deliberations of the Nomination and Compensation Committee and the resolutions of the Board of Directors.

Director compensation utilizes performance-based rewards in addition to fixed compensation. This approach stems from our intent to provide sound incentives that align with our aspirations for sustained growth.

Total Officer Compensation in FY2023*

- The above rewards include one director who resigned during FY2023. The rewards are not allocated to outside directors.

Evaluating Board Effectiveness

In order to tie our efforts to continuous improvement of the effectiveness of the Board of Directors, we conduct an annual survey among all directors and corporate auditors, asking them to consider the state of deliberations and operations of the Board of Directors. The Board of Directors analyzes and evaluates the results of these surveys, considers and implements measures to address the issues identified, and constantly strives to improve the effective functioning of the Board of Directors.

- Key Measures in FY2023

-

- Reviewing the Board of Directors rules, matters for resolution, and matters to be reported

- Reassessing transactions with shareholder groups and competing business areas (deliberations on transactions with shareholder groups)

- Structuring the Board of Directors, supplementing expertise, and conducting training and education

- Implementing well-balanced allocation of discussion time, including for written resolutions

- Introducing a Board of Directors web portal

- Assessment Outcomes for FY2023

-

- We identified a need to prepare briefing materials with greater clarity of issues to be discussed

- We aim to continue increasing the number of outside directors who are not affiliated with our shareholder companies

- Key Measures Heading into FY2024

-

- Ensure diversity, including increasing the ratio of non-Japanese and female directors

- Further systematize training programs for newly appointed officers

- Enhance document creation guidelines for the Board of Directors

- Hold meetings in key regions (including overseas)