A new era for energy. Where does electricity come from?

30 March 2023“I wanted to build a globally competitive company.”

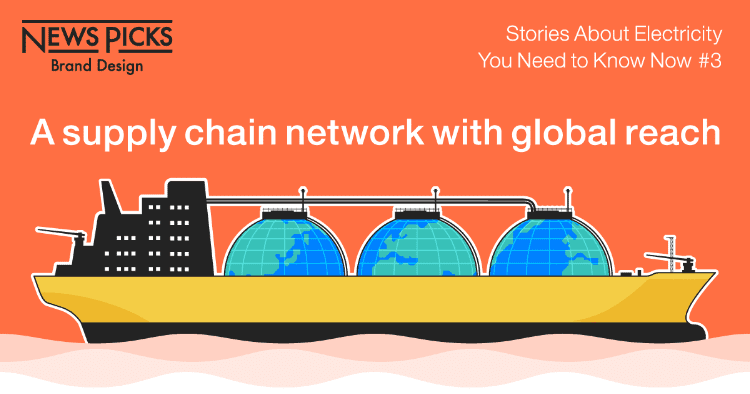

These are the words of Yukio Kani, one of the key people behind the establishment of JERA, the thermal power generation company created through the business merger of Tokyo Electric Power Company and Chubu Electric Power Company.

After joining TEPCO, from 1996 to 1998 Kani was involved in project financing for overseas power producers and became keenly aware of “the importance of capital investment” in maintaining the electricity infrastructure.

The old facilities at the JERA Anesaki Thermal Power Station, which supported the supply of electricity during Japan’s period of rapid economic growth.

Constructing power supply facilities requires careful planning, adopting a project financing scheme, and then working frantically to raise the needed funds. Meanwhile, fuels such as gas and coal must be procured from global markets.

I’ve seen a lot of developing countries. You can’t rebuild your power generation facilities without financial resources, and ageing power infrastructure leads to frequent power outages. When this happens, global companies and investors move out. Industry doesn’t grow in countries without stable electricity infrastructure. (Kani)

INDEX

We needed a company that could compete globally

Kani later took charge of procuring fuel from overseas, but after 2000 the global call for a “nuclear renaissance,” brought investment in thermal power generation in Japan to a halt.

Eighty to ninety percent of the cost of thermal power generation in Japan is the cost of fuel sourced from global markets. Back then, TEPCO was the world’s largest buyer of LNG, but demand for LNG was shrinking in Japan even as it was increasing in emerging economies like China and India. This meant increased competition, and if we didn’t do something we would lose out and become unable to provide a stable supply of electricity. We were aware of this risk in 2000.” (Kani)

On 11 March 2011, Kani was in Perth on the west coast of Australia. Having just wrapped up negotiations with supermajor Chevron to acquire a large-scale LNG concession, news of the Great East Japan Earthquake broke at the airport as he was returning to Japan.

One by one, the row of TVs in the lounge switched to images of the tsunami, blowing away my sense of relief that we had finally secured resources after two years of negotiations. On the plane, I thought about what might happen next. How could we continue to invest in power generation facilities and resource development, and how in particular could we avoid being outbid on the global market for LNG? As soon as I returned to Japan, I developed the concept that would lead to JERA’s founding, gathered a group of like-minded colleagues, and began preparing a proposal for restructuring the power industry. (Kani)

The Great East Japan Earthquake was a turning point for Japan’s energy policy. In the wake of the accident at the Fukushima Daiichi Nuclear Power Station, nuclear power plants across the country ceased operations, leading to a long-term dependence on thermal power generation.

Kani’s proposal was to divest TEPCO of its resource development, fuel procurement, transport, and thermal power generation businesses and move forward in replacing its already aging thermal power generation facilities.

At the same time, his proposal would also create a strong corporate entity that could compete globally across the entire value chain in order to consolidate its energy supply platform.

That‘s how we got to where we are today, by establishing JERA in 2015 and then integrating the entire value chain in 2019 with the addition of the power generation sector. We haven’t even been a fully integrated joint venture for four years, but we’re incredibly committed to our mission and vision. Never forgetting these starting points, we want to grow by driving the decarbonization of society. (Kani)

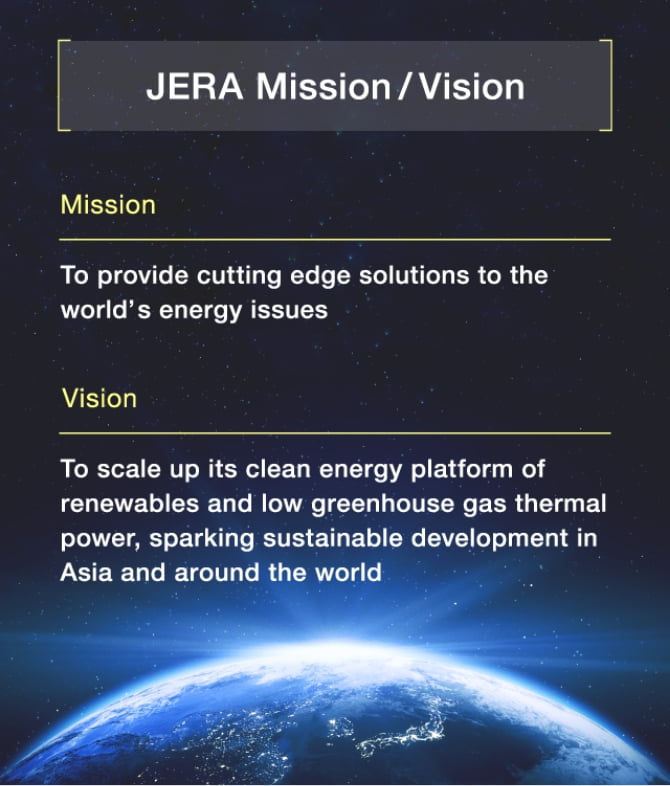

Taking on the world’s energy’s issues

JERA’s mission is “To provide cutting edge solutions to the world’s energy issues.” In Kani’s view, these “energy issues” can be broken down into three main areas:

• Sustainability (environmental sustainability)

• Affordability (availability at a reasonable price)

• Stability (availability of a stable supply)

In simplest terms, sustainability means reducing CO2 emissions, affordability means providing electricity at reasonable rates, and stability means dispersing geopolitical risks to ensure a stable supply. The trick is to resolve all three of these issues at the same time.

JERA is working on three means of doing so: LNG, renewables, and hydrogen/ammonia.

You can’t compete by looking only at the domestic. Instead of just buying LNG to sell, you have to secure the gas fields, invest in LNG liquefaction terminals, own a fleet of vessels, and take responsibility for transportation, trading, and all the way to power generation. JERA is unique in its involvement with the entire LNG value chain from upstream to downstream. For Japan, which has no natural resources, it’s like an insurance policy to ensure stable, low-cost procurement. (Kani)

JERA currently has five LNG upstream operations, a fleet of 19 LNG carriers, 11 LNG terminals, 66 GW of gas-fired power plants, and procures LNG from 16 countries.

JERA’s LNG trading volume is among the largest of any single company in the world. Kani initiated LNG transportation and trading while in the Fuels Department at Tokyo Electric Power Company (TEPCO) as a means of improving his bargaining power with sellers.

Until then, LNG was handled by a few oil majors and state-owned companies as a quasi-monopoly, so sources of supply were more limited than for fuels like coal and oil.

Shipping schedules and the timing of deliveries were controlled by sellers—the resource-rich countries—and the Asian countries downstream in the value chain were in a weak position. Surcharges were sometimes added as a “Far East premium.”

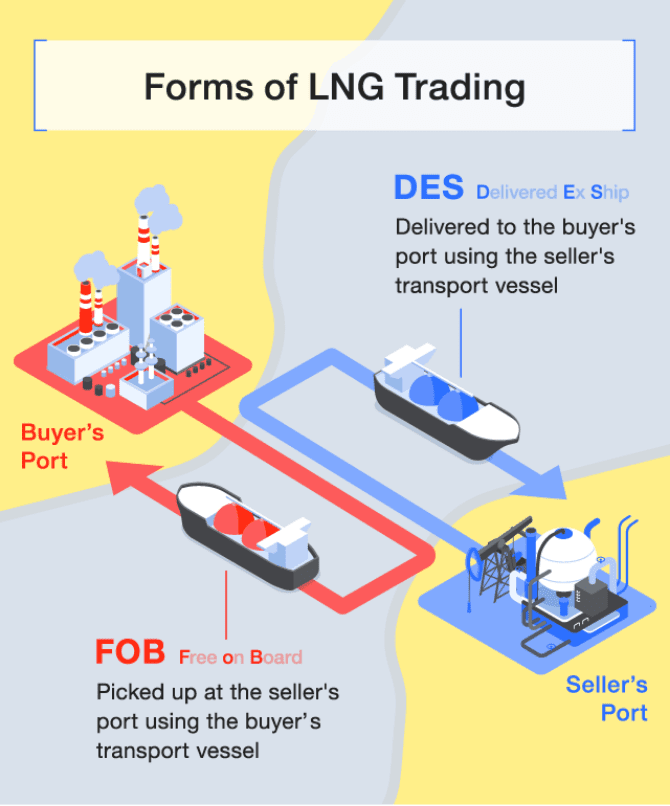

Until around 2000, the only way for Japan to import LNG was to have it delivered by the seller’s tankers (DES). Able to buy only from a limited number of suppliers, we had no choice but to do as we were told. Therefore, although it was difficult at first, we increased our options by arranging our own vessels and going to the seller’s port to pick up the goods (FOB). More suppliers were then willing to sell to us since we could pick up the cargo ourselves. Being able to see how transportation costs were structured , we could tell when we were being overcharged for freight procured through DES. Finally, we were able to really negotiate. (Kani)

What took this even further was investment in upstream development projects in gas fields and liquefaction plants.

JERA is currently involved with oil majors in a total of five large upstream development projects in Australia and the US. This is also a way of looking inside the “black boxes” that exist here and there in the value chain, increasing the number of equal partners and dispersing risk.

The same is happening with next-generation fuels like ammonia and hydrogen that JERA is promoting. The development of ammonia combustion technology and the procurement of fuel ammonia are key to achieving zero-emission thermal power, which is at the heart of the JERA Zero CO2 Emissions 2050 roadmap for JERA’s business in Japan.

JERA is also investing in ammonia and hydrogen production, seeking to develop new value chains starting from the upstream.

Ammonia today is mainly used as a fertilizer, making it an essential resource for food production. To avoid impacting this, we need to create a new value chain for fuel ammonia, like the one for LNG, in preparation for full-scale operation of ammonia combustion. (Kani)

Renewable energy and ammonia value chains

JERA has been involved in renewable energy development since 2016., even before the integration of its parent companies’ thermal power generation businesses.

Whether solar or wind, renewable energy whose supply fluctuates with the weather require a back-up power source.

Technological advances may lower the cost of storage batteries in the future, but the outlook now is poor so it falls to thermal power to bridge the gap. Our ability to regulate using gas-fired power is particularly important. Although we eventually want to switch from LNG to hydrogen, we are starting with coal-fired power first.

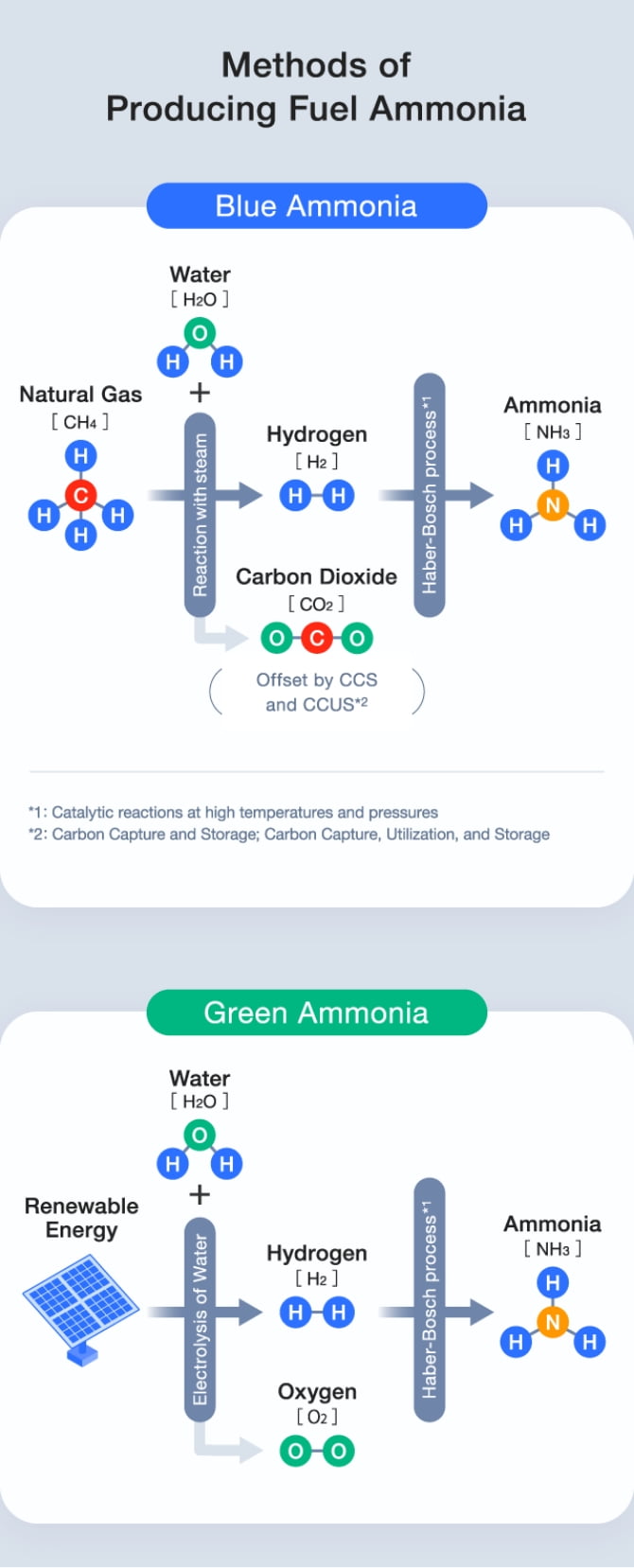

We are now working on a demonstration to increase the ammonia converting rate for coal-fired power generation, but achieving zero emissions will require using clean electricity that does not emit CO2 during the production of fuel ammonia either.

There are several types of production methods. Green ammonia is manufactured using renewable energy. Blue ammonia takes hydrogen from natural gas and offsets the CO2 produced using, say, carbon capture and storage (CCS). For either of them, we can make use of the contacts and know-how that JERA has built up in the renewable energy and LNG value chain businesses. (Kani)

In September 2022, JERA announced a collaboration with Uniper, the German power generation company, related to the procurement and sale of LNG and clean ammonia. The company responsible for ammonia production in this case is ConocoPhillips, one of the US oil majors.

ConocoPhillips sold the LNG for the first LNG-fired power generation in the world, conducted by Tokyo Electric Power Company in 1969. They delivered LNG to a base in Yokohama, and it spread as a new fuel. We have that connection with them, and remain in regular contact.

In fact, the players in large-scale developments such as offshore wind and ammonia/hydrogen are the same as for LNG—the oil majors. They have the financial resources and the know-how in resource development and transport. Issues like decarbonization are shared worldwide, so the faces are the same.

No matter who I meet, they say, “Ten years ago all we needed to talk about was LNG.” Now we start by talking about LNG, then move on to renewables, and finally to cooperation in hydrogen and ammonia. (Kani)

Creating options for an uncertain future

When we announced we were pursuing thermal power generation with fuel ammonia as part of the JERA Zero CO2 Emissions 2050 declaration in 2020, nobody else was thinking about transporting large quantities of hydrogen in the form of ammonia and the reaction abroad was chilly.

But JERA has been testing to convert coal to ammonia at the Hekinan Thermal Power Plant, has been developing large ammonia carriers with NYK Line and Mitsui O.S.K. Lines, and has announced a consortium with domestic power companies to look into collaborating on the introduction of hydrogen and ammonia.

Furthermore, following the ammonia collaboration with Uniper, we announced two large ammonia upstream projects on the first day of the Davos conference in January 2023. One of these projects is a collaboration with the Norwegian company Yara in the US.

At Davos, I had an in-depth discussion with Svein Tore Holsether, CEO of Yara, the world’s largest ammonia distributor, about the future development of the business. Holsether is also a member of the World Economic Forum’s Alliance of CEO Climate Leaders, which opens up further opportunities to widen the circle of cooperation. (Kani)

The situation with fuel ammonia today is a lot like that of LNG 50 years ago. Although the number of inquiries from overseas has certainly grown, JERA is still the only operator in the world to be engaged in ammonia thermal power.

Going forward there may be some small-scale examples of local production for local consumption in Japan, but procuring this new fuel cheaply and stably is going to require production and transportation from large-scale facilities overseas.

The quickest route to get there is to increase the number of players in the ammonia value chain, both sellers and buyers alike. JERA’s leadership in taking risks and offering new solutions to the world together with our partners will give us more options in an uncertain future and lead to a stable supply of electricity. (Kani)

Produced by NewsPicks Brand Design

Edited by Koji Uno

Designed by Haruna Kusumi, Kumi Kotani

Photographed by Kazushige Mori

This article is based on a Japanese article produced by NewsPicks Brand Design, which sponsored and translated by JERA.

https://newspicks.com/news/7893173/

※ May 10, 2024, some wording was changed.

RELATED STORIES

Connecting to the Next Generation: University Students Consider the Future of Energy

It's 10:00 a.m. on Friday, February 10, 2023. The air is humid in the Kanto and Chubu regions due to a southern …

Making the Most of Reclaimed Vehicle Batteries: Power Storage Solutions to Promote Renewable Energy

In February 2023, we visited Yokkaichi Thermal Power Station in the city of Yokkaichi, Mie Prefecture.

JERA Aims “Zero CO2 Emissions” with Acquisition of Parkwind, Belgium's Leading Offshore Wind Power Company

On March 22, 2023, JERA reached an agreement with Virya Energy, shareholder of Parkwind, a major Belgian offshore wind …